Many individuals use debit cards as the ultimate means for automatic payments. This is because it is a relatively hands-off and straightforward method to pay your bills on time without having to add to a credit card balance. But what happens if you decide to cancel your debit card?

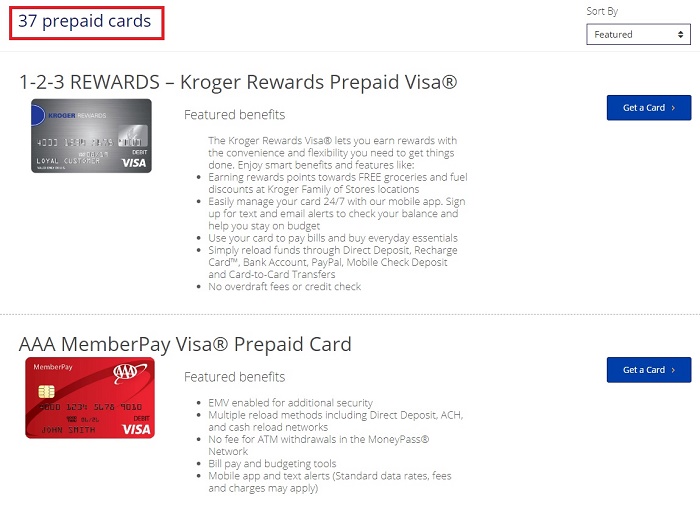

A debit card that has been issued by your bank depends on your savings account for the financing. However, a few debit cards might receive money via a prepaid agreement between the card issuer and you.

Pending payments on debit cards are relatively common. Generally, if you cancel your debit card, any pending or automatic payments that were set up with your debit card will stop and not go through. Keep reading to know more about this and save yourself some problems.

What are pending payments?

Contents

Sometimes in your forthcoming transactions list, you will see some payments in line with either of the two statuses: Pending or Scheduled. The former refers to the forthcoming automated payments, which can be altered.

You can alter the date of your pending or automatic payments by tapping on the “Edit Payment Amount and Payment Schedule” link on your main dashboard. The bank account you use for this particular payment can be updated till the day before the payment commences.

On the contrary, the latter refers to the forthcoming manual payments. Here, you cannot edit the bank account, the amount, or the date. However, you can cancel the scheduled payments by simply tapping the “Cancel” button before the payment day and time.

What happens if I cancel my debit card?

Pending charges on a debit card are an approval hold placed on an account for a particular sum of money. At the same time, the issuer finds out if the charges can be implemented or not. Typically, a pending transaction lasts between 1-3 days.

It is usually substituted by the transaction’s actual amount, such that the final and pending charges will be the same. However, the final charge amount is unspecified, so these two amounts differ from each other.

Either way, the projected pending amount is subsequently substituted by the actual purchase amount. If the transaction never goes through, the hold will ultimately be freed. The amount will be accessible for the cardholder once again.

Generally, if you cancel a debit card, any pending payments will not go through. Moreover, you will have to bring each account up to date with the new payment method.

➡LEARN MORE: What to do if I have an overdrawn bank account with no money

Backup payment method when you cancel your debit card

After your debit card issuer declined the payment, it will automatically pass on to the next registered account. If the firm that usually debits your account doesn’t permit a backup payment approach or you don’t have one specified, you might be obliged to extra charges after your debit card issue refuses the payment.

Being alert of your liability

Whether you can close your account if your bank card has pending amounts really depends on the card issuer’s policy.

Most companies do not permit you to close your account voluntarily if there are any pending charges. If you are negligent towards your payments, the card issues will eventually be forced to close your card.

However, even if you have the authority to close the card or the card issuer closes it, you will still be accountable for the charges made on it, despite when they will be posted.

Hence, as far as your bank account has a balance, you will be entitled to get statements and will supposedly have to pay off the balance figure.