As we step into the tax season, it’s crucial to understand how to maximize your tax deductions. One often overlooked aspect is medical expenses. If you have incurred hefty medical bills in the past year, they could help you save on your tax bill. This article aims to demystify tax deductions on medical expenses, helping you make the most of your tax refund.

Understanding Tax Deductions

Contents

When filing your taxes with the Internal Revenue Service (IRS), you are required to report all your income from the previous year. This includes wages, interest, and dividends earned on investments. However, the IRS also allows deductions from your income, which can lower your taxable income and, subsequently, the amount you owe.

Deductions are certain costs that lower your taxable income. They encompass a wide range of expenses, including certain medical costs, donations to charities, interest on loans, contributions to retirement accounts, and other taxes you pay.

The logic behind deductions is simple. If you donated $2,000 to charity last year and your income tax rate is 22%, deducting that $2,000 will lower your tax bill by $440.

You can choose to take the standard deduction or itemize your deductions. For 2022, the standard deduction was $12,950 for individuals and $25,900 for married couples filing jointly. But if your medical costs are substantial, you might want to consider itemizing your deductions.

Interested in more ways to save on taxes? Check whether your health costs qualify for a health savings account (HSA) or flexible spending account (FSAs) with our free medical expense eligibility tool.

Medical Expenses Eligible for Deduction

The IRS allows the deduction of costs used to pay for medical care to diagnose, treat, or prevent a medical problem. The costs can be for yourself, your spouse, or your dependents and might include expenses such as:

- Hospital care and nursing home care

- Transportation costs for medical care

- Participation in a weight-loss program for a specific medical condition

- Payments to healthcare providers such as dentists, doctors, mental health professionals, and surgeons

- Prescription drugs and eyewear

- Hearing aids

However, the IRS does not allow deductions for cosmetic surgeries or expenses for general health, such as gym memberships or over-the-counter drugs.

Surprising Medical Deductions

There are some lesser-known items that you can deduct from your taxes, including:

- Breast pumps and related supplies

- Durable medical equipment like wheelchairs, crutches, or blood testing strips for diabetes care

- Home modifications for health reasons (like adding an entrance ramp)

- Counseling or medical care for addiction

- Programs to help quit smoking

- Visiting nurse services

Understanding the Deduction Limit

While there is no cap on the amount of medical costs you can deduct, you can only deduct costs that exceed 7.5% of your adjusted gross income (AGI). Your AGI is your total income after all other deductions have been taken. So, if your AGI is $40,000, and you spent $7,000 on medical costs last year, you would be able to deduct $4,000 ($7,000 minus $3,000).

However, medical costs must meet two other criteria:

- They must meet IRS rules about costs you can deduct; for example, you can’t deduct costs for over-the-counter drugs.

- Medical costs must also be unreimbursed; you can’t deduct costs that insurance paid for, nor can you deduct costs that you paid for with an HSA or FSA.

If your total costs do not exceed the standard deduction, you don’t need to claim them on your taxes. But if you have a lot of medical costs, you may want to itemize your deductions.

Unconventional Medical Deductions

Certain unconventional treatments, such as acupuncture, trips to the chiropractor, and nontraditional medical practitioners, including Christian Science practitioners, are also deductible, particularly if a doctor prescribes them.

Adaptive Equipment Deductions

You can also deduct the costs of adaptive equipment like wheelchairs, bath chairs, bedside commodes, and other items needed for a disability or condition. Special hand controls and other special equipment installed in cars for people with disabilities are also deductible. The cost of an artificial limb or artificial teeth can be included as well.

Medical Expenses for Newborns

Breast pumps and other nursing supplies that assist lactation are deductible. If your baby formula requires a prescription, the cost in excess of the cost of the regular formula may be allowed.

Diabetes-Related Costs

Blood-testing kits, including blood strips and batteries, are deductible. So is insulin, even though it is not technically viewed as a prescription drug.

Eye and Ear Related Conditions

The cost of eye exams, contact lenses, lens solution and cleaner, and prescription eyeglasses (including sunglasses) is deductible. Eye surgery such as LASIK and radial keratotomy to treat vision problems also qualifies. Braille books are also deductible. For those with hearing issues, the costs of exams and hearing aids (including batteries) can be deducted.

Home Improvements for Medical Conditions

For those who have had to make changes to their home to accommodate a disability, the cost may be fully deductible. Examples include constructing ramps, widening doorways, lowering or modifying kitchen cabinets, and adding support bars.

Sign up for our newsletter today to get our best tips for living your healthiest life delivered straight to your inbox. Sign up

Pandemic-Related Medical Expenses

The cost of any COVID-19 treatment is tax-deductible as an itemized deduction, just like ordinary unreimbursed medical expenses. If you have any medical treatment expenses or related travel expenses for COVID-19 that haven’t been reimbursed, those can be deductible if you itemize.

Non-Deductible Medical Expenses

Any medical expenses you get reimbursed for, such as by your insurance or employer, can’t be deducted. The IRS generally disallows expenses for cosmetic procedures. You typically can’t deduct the cost of nonprescription drugs (except insulin) or other purchases for general health, such as toothpaste, health club dues, vitamins, diet food, and nonprescription nicotine products. You also can’t deduct medical expenses paid in a different year.

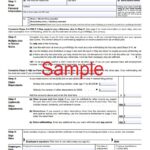

How to Claim the Medical Expense Deduction

To claim the medical expense deduction, you must itemize your deductions. Itemizing requires that you don’t take the standard deduction. Normally, you should only claim the medical expenses deduction if your itemized deductions are greater than your standard deduction.

If you elect to itemize, you must use IRS Form 1040 to file your taxes and attach Schedule A.

- On Schedule A, report the total medical expenses you paid during the year.

- Enter 7.5% of your adjusted gross income.

- Enter the difference between your expenses and 7.5% of your adjusted gross income.

- The resulting amount will be added to any other itemized deductions and subtracted from your adjusted gross income to reduce your taxable income for the year.

The world of tax deductions can be complex, and it’s recommended that you consult with a tax professional about deducting medical costs. By understanding and applying these principles, you can ensure you’re making the most of your eligible medical expense deductions.