There is a misconception about nonprofit organizations, which is to believe that they have owners rather than founders. There is a profound difference, and one of the most controversial questions is if the founder of a nonprofit can receive a salary?

Basically, they do not obtain profits or benefits from the net income of the foundation derived from fundraising, grants, sponsorships, among others.

However, they can receive money through other ways, which we will explain in this article.

Role of the founder of a nonprofit

Contents

The vast majority of commercial companies pursue profits for their founders; these members are “shareholders” because they provide the capital and then distribute the net profits between each other.

However, nonprofits are different; although founders seek to increase the income of the organization, they do not take any part of it; this means that no one can be a “shareholder”; they are called directors or founders.

A nonprofit generally receives more income than the amount of expenses, and is also exempt from paying taxes since they have 501(c) status.

So, what do they do with the not used assets at the end of their annual accounting cut? Unlike commercial companies, they are reinvested to continue carrying out more activities and programs for the organization.

These funds must remain within the organization to ensure compliance with its following objectives.

Payments at a nonprofit

State law and the Internal Revenue Service (IRS) do not prohibit nonprofit organizations from paying significant wages to its employees, agents, and directors.

But, in some cases, they employ only a few key people and rely mostly on volunteers; this is generally the case for small, local nonprofits.

Mainly, these organizations cannot divide income among their members, but they can allocate a part of it to payroll expenses.

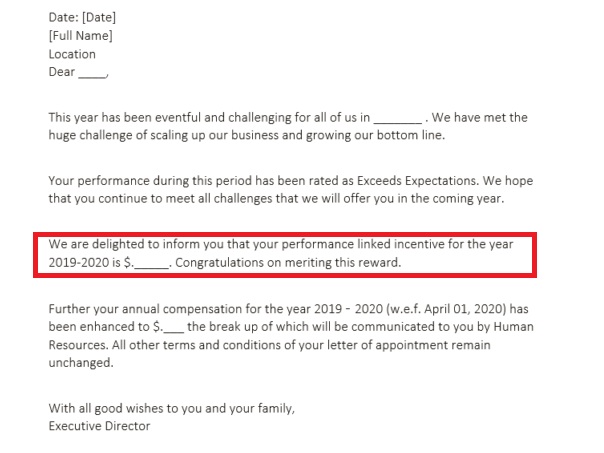

On the other hand, founders can work in any position in the organization’s structure, receiving their compensation, but that does not mean that they can estimate an exorbitant salary.

This is secured by the Inurement section of the Internal Revenue Code (IRC), which says that the payment should not be excessive and that no individual can take advantage of the nonprofit’s net worth.

To be sure, the IRS constantly audits the employees’ and founders’ salaries to see if there is an overpayment.

For example, if this occurs with a founder, he will most likely have to pay an individual tax, and the organization could lose its tax-exempt status.

➡ READ ALSO: How to raise money for a nonprofit

How to determine the payment?

The IRS establishes that the payments must be reasonable, but it does not define completely what “reasonable” is.

However, they determine it with some factors such as:

A good description of positions

Describing every position in the organization will help to determine if each one has the remuneration according to its importance.

Work hours

The most common method to determine the salary of the staff of any company is calculating their work hours.

Description of educational level and experience

Professional fees are, sometimes, more expensive than regular salaries. So, when there is a job that only one person can do (because it requires specific educational level or experience), the compensation should be higher.

Budget of the organization

The salary of a nonprofit’s members can be calculated depending on its income and expenses. For example, a local organization, with few activities and little growth, could not allocate most of its capital to the payroll of employees.

Caution in the administration of payments

Those who want to create a nonprofit must be careful about managing expenses because of the exposure to public critics.

For example, organizations that spend less than a third of their funds on their charitable goal have a poor qualification by groups like Charity Navigators.

Charity Navigators is an organization that evaluates the efforts of US nonprofits; it is an impartial and free medium that does not accept advertising or donations from the organizations it evaluates.

Any organization must be able to demonstrate that its funds are being spent on their primary purpose.

In other words, if the founder of a nonprofit pays himself -or its employees- an unusually high salary, it will lead to many problems.

Conclusions

There are many benefits when working for a nonprofit organization. However, it is extremely important not to take advantage of them since the IRS will be examining everything.

Founders must understand that even if they earn a salary, they do not own the profits of the organization.

Essentially, the real purpose of this works is to make a positive change in society, not a fortune.