As we know, a nonprofit’s purpose is to serve the public interest and help the community where it is located. It can be dedicated to health assistance, religion, arts, economy, civil rights, awareness of environmental issues, culture, education, among other areas.

By the time of establishing this type of organization, you need to specify the bylaws. They are like a “guide book” where you can find the principal guidelines and rules for your nonprofit to operate optimally.

In this article, you will find a list of the best practices and advice to create bylaws in your organization.

What are nonprofit bylaws, and why are they important?

Contents

Nonprofit bylaws are a group of guidelines where the founders describe how to operate and how to make decisions. It consists of a manual where it is written all the information about running the organization.

Each association, nonprofit or not, must have this document; it is a Federal and State Law that you must fulfill when establishing the Article of Incorporation.

In the bylaws you can regulate things like:

- How often will the board of directors meet? (weekly, monthly, etc.).

- What are the requirements to become a director?

- What will be the structure of the organization chart? And how often should it be reviewed?

- How will the funds be distributed?

- Among others.

On the other hand, bylaws must be well written so everyone can understand them. If you do not know how to start, check out these tips.

➡ READ ALSO: Can family members be on a nonprofit board

Best practices to create nonprofit bylaws

Get assistance from an attorney.

Although you can find several templates on the internet, and you may have an idea of how you want to run your organization, there are mandatory requirements that you need to include in the document to consider it valid.

Sometimes, an attorney with nonprofits knowledge is the best option to be sure that the bylaws do not contradict the State Laws.

Write the general terms.

It is better if you do not include information about things that may change in a short time. Bylaws should only refer to essential information; otherwise, you will have to change it every time something unexpected happens.

For example: You can specify that the board of directors meetings will be held twice a month, instead of saying that they will be held only on Mondays at 5:00 pm.

It will be more beneficial if you write generally, but being concise.

Consider to make your bylaws public.

Nonprofits bylaws are not a public document, since these organizations are not mandated to enable access to their information.

However, if you make them public, it will increase the people’s trust in your organization. Open nonprofits, generally, inspire straightness, receive more donations, and have several volunteers’ requests.

Know the legal difference between “may” and “shall”.

Although you probably use these words as synonyms in your daily talk, when it comes to legal documents, they are different.

If you want to specify something as an obligation or as something that must happen, use “shall.” On the other hand, use “may” to refer to optional things.

Write bylaws according to the type of nonprofit.

A social assistance nonprofit is completely different from a health nonprofit, so, make sure that your bylaws are designed for your organization.

Here is an advice: Write the main objective of the nonprofit, as well as the mission and vision. This will help to identify if a bylaw is consistent or not.

Also, take into consideration the specific conditions of the community where your group operates, the people you work with, and how many workers are in it.

Write a dissolution clause.

It may seem strange, but when creating a nonprofit you also need to write down a dissolution clause. It is required to specify how the assets’ distribution will be in case the organization is about to dissolve.

Generally, nonprofits must re-invest their money in their own charities to maintain the tax-exempt status, but in the case of dissolution, that money will have to be distributed, so make sure to specify this process.

Review the bylaws.

Since nowadays our lives condition is continuously changing, we recommend you to review the bylaws at least every two years; this will help to ensure that stipulations are in accordance with your current mission and vision, and that the information you are providing to The Internal Revenue Service (IRS) is up to date.

Sample

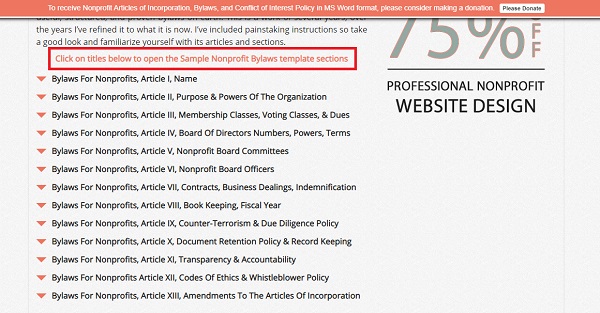

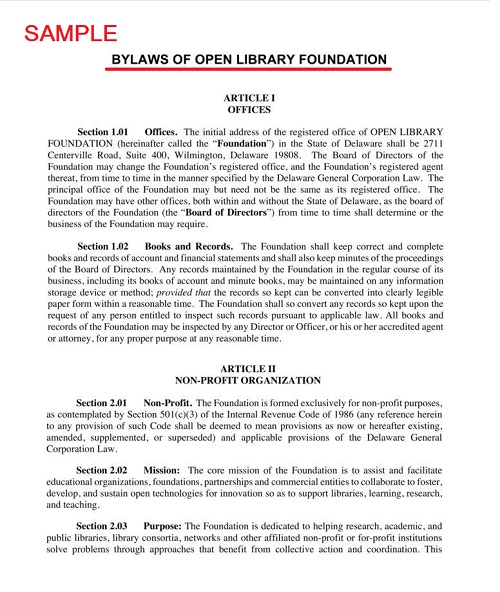

Besides all the tips we mentioned before, here is a sample that you can use as a guide to write your bylaws: https://form1023.org/how-to-draft-nonprofit-bylaws-with-examples