DUNS number is a unique 9-digit number created by credit bureau Dun & Bradstreet to identify a business. It is considered to be a standard numbering system for the identification of a business around the world.

DUNS stands for Data Universal Numbering System. It was created and copyrighted by Dun & Bradstreet in 1962. It is also one of the three top business credit bureaus.

People often confuse the DUNS number with the Federal tax ID number, which is different. It is used explicitly for business credit reporting, whereas the federal tax ID number is used for tax identification and issued by the IRS.

Stay tuned to learn more information regarding the DUNS number for your business:

Why Do You Need a DUNS Number?

Contents

It establishes your company’s D&B® file, which can be helpful for you and your business partners in many ways.

Show Your Business Worthiness

DUNS number shows your business credit profile. So whenever vendors or suppliers want to work with you, they can check your business credit profile using the number to make an informed decision. However, you should remember that your company’s D&B® file would not be of much help to you if you didn’t have a strong business credit history.

Get Longer Term Trades

DUNS number showing a solid business credit history can help you get longer-term trades with your suppliers

Protect Your Personal Credit

If you don’t have DUNS, you have to use personal credit for business purposes. DUNS keep you safe from using your personal credit and thus protect it from late payments or high debts.

More Opportunities

Another enticing benefit of DUNS is more chances to local, state, and federal contracting opportunities. All such options require your number, so you will more likely secure a good opportunity.

How to Get a Dun & Bradstreet Number

Before registering for a DUNS, you should check whether your organization already has one. In most cases, major businesses such as colleges, universities, libraries already have DUNS numbers. You can ask the financial administrator, financial officer, or another authorizing official regarding your organization’s DUNS.

Register For DUNS Number in Two Ways

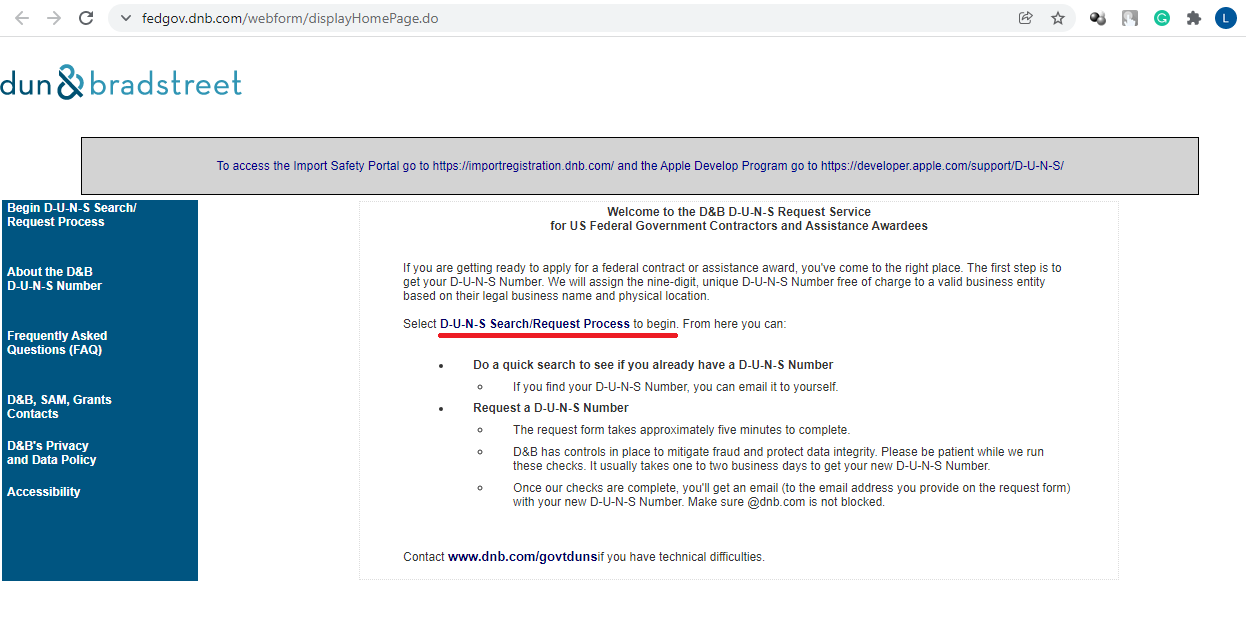

(D&B) Website

If no one knows about the organization’s DUNS number, you can check it yourself at the Dun & Bradstreet (D&B) website and register here for the new number.

Toll-Free Number

Or you can call at 1-866-705-5711 to search or register for a DUNS number.

When you apply for it, D&B places your company on a D&B marketing list sold to other companies. If you don’t want to market your business credit profile, you can request not to be added to this list.

Registration for the DUNS is free of charge. If any organization or website demands a fee for a DUNS number, it is most likely a scam.

It may take 2-3 days to get the DUNS after applying.

You will need the following details to get it:

- Organization name

- Organization address

- Chief executive officer (CEO) or organization owner name

- The legal structure of the organization (e.g., corporation, partnership, proprietorship)

- Year when the organization started

- Primary business type

- Total number of employees (full and part-time)

Register at SAM.gov

Once you get the DUNS number, you should register annually at SAM.gov to be eligible for financial assistance.

You will need details required for the DUNS, tax identification number, and other important data to complete registration at SAM.gov. It will take about 30minutes to complete the application.

You have to wait 3 -14 days to have active SAM registration.