If an individual is planning to purchase a vehicle for business use, they can write off a portion of the car’s cost price in taxes. This is applicable if the individual is planning to use the vehicle solely for business use. Writing off a leisure trip as business travel in federal taxes is not as easy as one imagines.

The tax collection agencies are quite thorough about the process and require documentation as well. However many of you must have this question in mind that “Can I deduct the purchase of a vehicle for my business?”

To understand how one can deduct the purchase of a business vehicle, the individual also has to understand what counts as business travel as well as how to claim the tax reduction for it.

Tax rules write off for purchase of a vehicle for business

Contents

If one is buying a car, they can employ the federal Section 179 and claim the deduction. The Internal Revenue Service (IRS) has certain ground rules for what are the requirements to claim the write off:

- If the vehicle is going to be used for business as well as personal needs, then only a portion of the price can be reduced. For example, an individual purchases a car for $23,000. The stipulated time for business usage is 75%. Then, one can waive $17,250 from the purchase only.

- The vehicle has to be used 50% of the time for business to be able to employ Section 179.

- For SUVs and other similar vehicle types, only $25,000 can be written off from the original price. There is a set limit of how much an individual can claim from Section 179, which is $1 million. If one is planning to apply a write-off for more than one asset, then the claim price can be reduced.

- If one is planning to trade their old vehicle for a new one, they cannot cut the trade value. They can only claim the cash amount that was required.

- If one has brought a vehicle previously for personal use, and it has transpired for both (Personal and business) or solely business needs, they will not be able to claim Section 179. The vehicle purchase should be done when the individual is in business.

- One can claim the depreciation on the car every year in business if they are not able to write off the entire price. It can be put as the loss of value of the vehicle due to the model getting older.

What is section 179?

Section 179 is an exceptional tax deduction that one can use to reduce one business expenses. This one claims tax write-off for business purchases such as vehicles and allows one to recover the depreciating value of the property.

How to know if one qualifies for it?

To be able to deduct the purchase of a vehicle for my business, one has to know whether they are qualified to employ Section 179 for the tax write-off or not.

As mentioned above, the vehicle purchased should be bought while in business and is being used for more than 50% of the time for business needs. Personal use of the vehicle will not be considered in the write-off and has to be deducted. One has to keep records of the business traveling when going out for it.

Additionally:

- Vehicles, machines, fixtures, and furniture should be eligible business property.

- Land and rented property do not come under Section 179.

- The purchase of the vehicle should be for business needs.

Deduction limitations on section 179

There is an amount limit that one can choose in the Section 179 form:

- The amount for claiming cannot be more than $1 million for one year under section 179. This is known as the Dollar Limit.

For vehicles for sport used in business, the IRS has specified that the maximum deduction cannot be more than $25,000.

- After the application of the dollar limit, one can reduce the total cost of a year. This includes the Section 179 reduction as well. This is the Business Income Limit.

However, an individual cannot use the section in case their business is going under or is not performing well. Although, if an individual is not able to take apart or full deduction benefits of Section 179, they can apply this in the following year with the calculations.

➡LEARN MORE: Can you back out of buying a car after signing papers?

How can one claim the deduction in the purchase of a business vehicle?

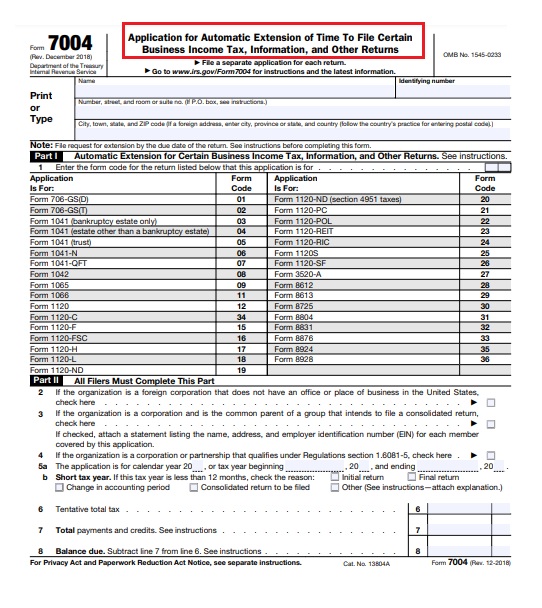

Firstly, one will have to fill the IRS’ 4562 Depreciation and Amortization form. They present the individual with 2 options. Either one can write off the per-mile expenses or the actual expenses.

- Actual expense: This requires the individual to keep a record of what one has spent on the vehicle. This includes repairs, oil, gas, maintenance, tires, lease payments, and deprecation. So, to speak, if one is using the vehicle for business for 60 percent of the time. They can simply multiply their expense by 60% and claim their write-off.

- Per-mile: IRS has a milage rate set which one has to use to claim the write-off by this option. Simply keep track of how many miles have been driven for business, multiply it with the milage rate, and that the amount one can claim from Section 179.

While one can reduce the actual expenses, one cannot switch to the per-mile option afterward. It is advised to pick the per-mile option for the first year of the vehicle purchase. As one can switch from per-mile to actual expense but not vice versa.

If one has more than 5 vehicles for business use in the same period, they cannot opt for the per-mile option. Also, the per-mile option is not applicable if the individual has already claimed the Section 179 write-off. This also applies if the individual has used the depreciation method.

In the case of auditing, what information should be kept?

Auditing may sound worrisome, but it is not. The IRS does these to ensure that an individual has given correct data of their finances or there is a system error due to which the data shown may be incorrect. One can keep a record of their vehicle’s business use in-app, notebooks, etc for proof.

The required information includes the following:

- Miles traveled

- Destinations (Starting and ending points of the journey)

- Day, Date of the trip taken

- The reason behind the trip (was it business or not?)

- Total miles are driven throughout the year.

- Spending cost on the car (oil, gas, repairs, maintenance, etc.)

While, one doesn’t need to have the information of every trip they take, but if they have a regular route which they use for business purposes, they are advised to keep an eye on the mileage and note it.

Vehicle purchases can be expensive, but they help a business owner in the long haul. The opportunity for an individual to claim a tax write-off for such purchases is a relief as well as a golden chance to invest more in their business.

Ensure that one has got all their information sorted in case IRS decides to audit. Not that getting audited is bad, these are check-ups, but they are meticulous.