There are several situations where you need to transfer money to someone else’s bank account: to pay for an online purchase, to send money to your son in college, to pay your debts, and so on. Formerly, we would have paid with cash, but right now, this is an easier way to manage our money.

Due to the invention of the Internet, bank institutions have created their official websites where you can sign in and access your bank account. These provide the possibility of transferring any amount of money from your bank account to another (it can be yours or someone else’s).

In this article, we will explain different options you can choose to transfer money.

Things you need to know before transferring money

Contents

When you open a bank account, you receive the entire financial documents related to it, including your account numbers.

The first thing you need to know is how much money you want to transfer and if you have such an amount in your account. In case you do not have enough, the transaction will not proceed; if it does, you will have to pay an overdraft fee.

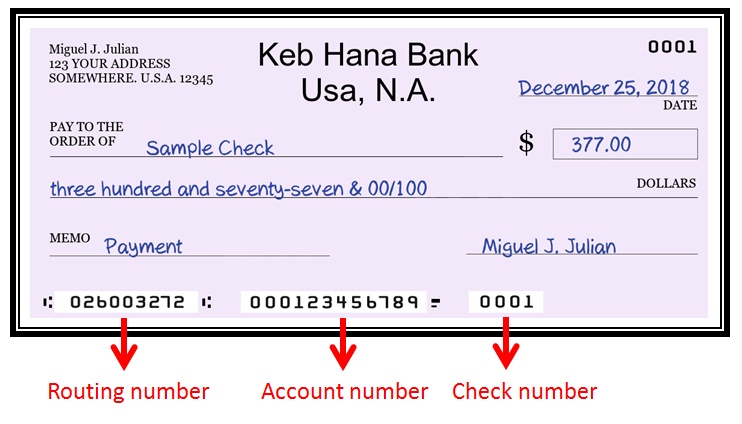

If you receive a personal check, you can immediately cash it or deposit it into your bank account to have the money needed in the transaction. Since it can be your first time doing this, you can talk to your bank to help you out with checks if you have any doubts about the process, and in the meantime, you should also know Important points you need to know before you cash out your 401k.

Depending on the virtual platform you use, by the time you transfer money to someone else, you must complete certain information about the bank account you are transferring to. The information you usually need is:

- Bank name and numbers (the six-digit sort code and the eight-digit account number).

- Name of the person or business you are transferring to.

- Its address.

- The date you want the money to be transferred.

- An alias: a personal reference so that the other person knows the transfer came from you; it is generally your name or your customer number.

- Routing numbers of your bank and the bank you are transferring the money; you can find this number in a check.

Options to transfer the money

Once you have the required information, you have two options:

Directly on your bank website

Basically, you log into the portal and transfer the money, but certain conditions depend on the other person’s bank.

- Within the same bank. When you are transferring money to another person’s account with the same bank, you will not have to pay any fee since the transaction does not demand external resources, it is done with the bank’s internal servers. Also, the duration is no longer than a business day; in some cases, the money can be delivered within minutes.

- Transferring to another bank. It is almost the same, but you will have to go through a more extensive process because there are more security measures. The delivery time is from 1 to 5 business days, and you will probably have to pay an extra fee.

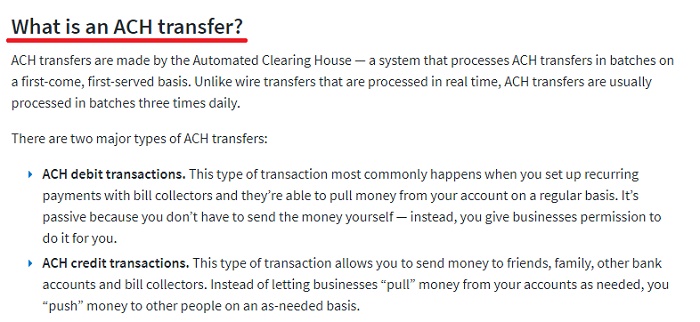

Generally, the banks use the Automatic Clearing House (ACH) network to supervise this type of transaction. You can find more information about this subject, in this article.

Using another platform

Currently, some numerous online services or apps allow you to transfer money from one bank to another quickly; here are some options and what you have to do:

- Zelle: It is an online service offered by most of the banks in the US. You only need the recipient’s email or phone number to transfer the money. Once you have entered the email or number, if the other person has a Zelle account, the money is immediately deposited.

Note that this service should only be used whit your family or close friends; it is not recommended to be used with strangers.

- PayPal: It is a popular online payment tool similar to Zelle. If you want to use this service, you have to create an account on its official page and then transfer your money to another person (who must also be registered in PayPal).

The funds will be deposited right away if you pay a fee (1% to 10% of the total sum); if you do not, the transaction can delay one day or more depending on your bank.

- Venmo: It is also an app to transfer money, such as Paypal and Zelle. You have to do the same process of signing up, and you will only have to pay a 3% fee if the money you are transferring comes from a credit card.