Section 8 is one of the social programs of the Department of Housing and Urban Development (HUD). It was created in 1965, and its primary mission is to guarantee decent housing to American citizens who are not capable of doing it by themselves because of their low income and other circumstances.

Nowadays, the HUD has numerous social politics like community housing development, low-income housing, senior housing, mortgages, education loans, and voucher assistance (also known as Section 8).

All of these programs have the purpose of providing people equal treatment between renters and buyers and ensure they live in good conditions. However, in this article, we will focus on explaining specifically Section 8.

Section 8 income limits

Contents

Section 8 is issued by local Public Housing Agencies (PHAs) and is specifically designed to assist families that have such a low-income that can not cover their rent rates.

The HUD helps these families by subsidizing the cost of their private rentals, but they need to fulfill specific requirements to obtain the benefit, such as:

– Family status.

– Citizenship of each member in the family (whether they are Americans or not).

– Eviction history.

– And income level (income amounts are one of the more essential requirements).

So, to qualify to obtain voucher assistance, the HUF will look at your assets and verify your incomes and bank balances.

In consequence, there are two circumstances related to your bank account that may affect your Section 8 program eligibility:

Amount less than $5,000.00

In case you have $5,000.00 or less in your bank account, all incomes derived from that money will be counted as “annual income.”

The most common case is interest-bearing bank accounts. For example: if you have $5,000.00 in your account and you earned $300 of interests, by the moment of calculating your annual incomes, the amount will be $5,300.00.

In other words, PHAs do not consider $5,000.00 as the actual limit; what actually counts is how much you earn from it.

Amount $5,000.00 or more

In this case, PHAs will do an in-depth study on your bank account because there are two amounts that the HUD could count as your “annual income”:

a. A percentage of your total assets (clothes, jewelry, receivable accounts, cars, etc.)

b. Or your actual annual gross income (employment wages, social benefits, pension plans, interests).

The PHA office will make a comparison between your annual gross income and a percentage of your total assets.

The largest sum obtained from that study is the one that they will count as your “annual gross income” to determine your eligibility to receive Section 8 voucher assistance.

Types of income

If you are considering to apply for the Section 8 program, these are the incomes you have to include in your annual earnings (if any):

- Salary.

- Tips.

- Overtime pay.

- Child support.

- Dividends or interests from assets.

- Retirement fund.

- Lottery winnings.

- Pension.

- Disability benefits.

- Social security benefits.

- Worker’s compensation.

- Alimony.

➡ READ ALSO: Load a Walmart MoneyCard

Family considerations

On the other hand, the family year income must reach the income level allowed by the HUD.

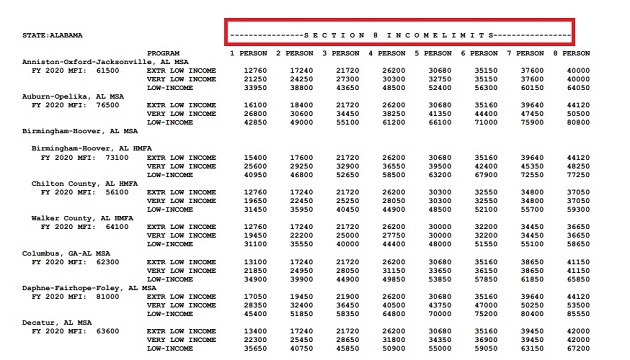

There are three levels, but they are different depending on where you live; each level is calculated according to the city median income:

– Extremely low income: 30% of the city median income level.

– Very low income: 50% of the city median income level.

– Low income: 80% of the city median income level.

Every year, the HUD publishes the income limits for each state. In this link, you will find a PDF whit the most recent information (2020): https://www.huduser.gov/portal/datasets/il/il20/Section8-IncomeLimits-FY20.pdf.

Also, the term “family” for the HUD may include from 1 to 8 members. In the same document, you can see the income limits for each family case.

Final thoughts

In conclusion, the lower the level of a family income, the higher the opportunity to be eligible for Section 8 (voucher assistance).

For example, if your family has an annual income of less than 30% of the median income criteria, you will probably obtain the benefit.

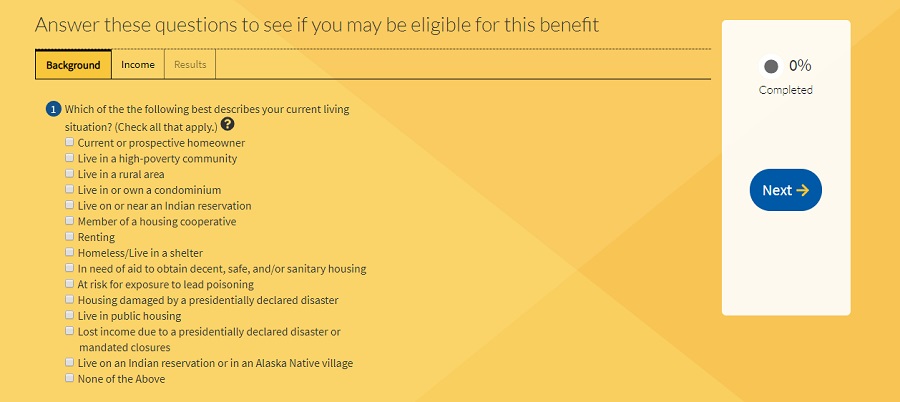

On the other hand, if you are interested in applying for this social program, we know that sometimes it can be difficult to see if you are eligible or not. But you can use this Eligibility Checker to find out.

And, In case you want to know what type of social programs suit you best, check this page: www.benefits.gov/benefit-finder.