The Internal Revenue Service (IRS) is the official tax collection agency of the U.S. It is in charge of issuing all the forms and regulations related to federal taxes, obligations to tax-payers, exemptions, and deductions.

Almost all workers, employees, and businesses have to pay them and to report their annual incomes and earnings. To do so, they have to complete a form, submit it to their local IRS office, and then make the payment.

In this article, we will explain how to file your taxes easily and when you have to do it.

Process to file taxes

Contents

This is likely the most common question related to taxes, but what actually defines if you have to file a tax return is how much you earn in a year, not how much time it took to you to obtain that money.

Also, there are income limits imposed by the IRS to determine who has to pay taxes; these limits involve certain conditions like your age, marital status, and if you have a dependant.

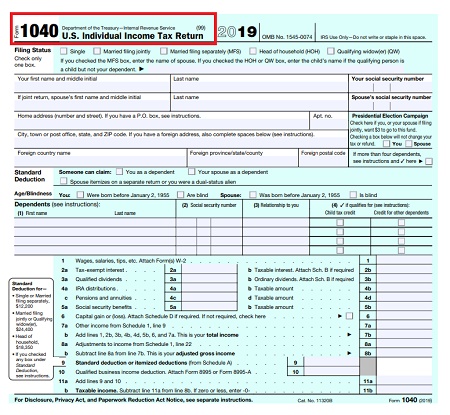

Generally, people use the Form 1040; this is the primary tax document.

By the time you are filling it, you will have to provide information about you (name and last name, address, marital status, date of birth), your dependant’s (if any), your spouse (if you are married) and the total amount of your incomes.

Here is the link to download the form, and the instructions to fill it (pages 12-42).

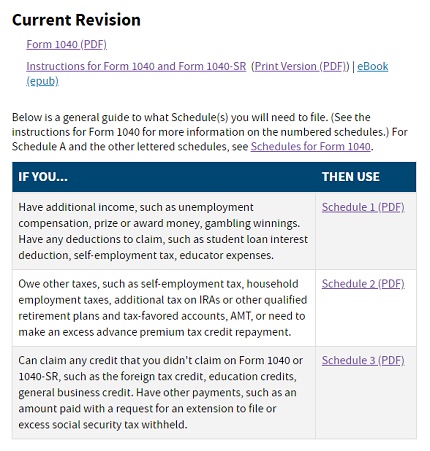

Besides, if you have additional income that you can not describe in Form 1040, you will have to file a “Schedule“. This is the criteria to choose the right one:

When do you have to file taxes?

One of the principles of Tax Law is that the annual income tax return must be filed the following year. For example, you will pay your 2019 taxes in 2020, your 2020 taxes in 2021, and so on.

Currently, the stipulated time to file your 2019 taxes is between January 27th, 2020, and April 15th, 2020, but due to the Coronavirus Pandemic (COVID-19), the IRS administration changed the deadline and extended it to July 15th, 2020.

➡ READ ALSO: How does Refund Taxes work

Federal income taxes limits

Since you have to file taxes depending on your annual gross incomes, here are the minimum income for 2019 (including the specific conditions):

Single filing status

- If you are under age 65: $12,200.00.

- If you are 65 or older: $13,850.00.

Married filing jointly

- Both spouses under age 65: $24,400.00.

- Both spouses are 65 or older: $27,000.00.

- If one spouse is 65 and the other is under age 65: $25,700.00.

Married filing separately

- Any age: $5.

Head of Household

- If you are under age 65: $18,350.00.

- If you are 65 or older: $20,00.00.

Qualifying widow(er) with dependent child

- If you are under age 65: $24,000.00

- If you are 65 or older: $25,7000.00

According to the IRS, the definition of gross income is all the incomes you receive in the form of money, property, goods, and services in a year (these incomes must not be tax-exempt to count them). And, you must also count anything you obtained from sources outside the United States.

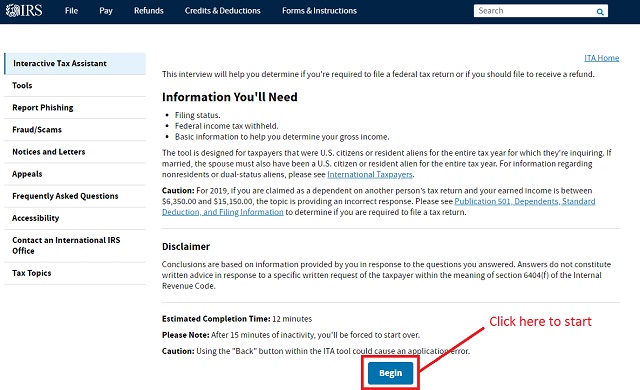

On the other hand, the IRS provides to all citizens an interactive tax assistant (ITA) to help you know whether you have to fill a tax return or not.

You can find it on their official website, and it consists of choosing some options about your incomes and living conditions. You can try it here: www.irs.gov/help/ita/do-i-need-to-file-a-tax-return.

Additional information: In case you meet the following conditions, you should read this page about international individuals tax obligations: www.irs.gov/individuals/international-individuals.

- U.S. citizens with incomes from another country.

- Foreigns with incomes in the U.S.

- Foreign residents with incomes in the U.S.