When we don’t fill out our tax returns or don’t pay on time, the Internal Revenue Service penalizes us and we must pay a penalty for non-compliance. It also works as an incentive for all taxpayers to fill out and pay their taxes on time since if they do not, they know they would have to pay more money due to the IRS interest.

This type of penalty is very common in all tax systems in the world. The tax administration imposes financial penalties on citizens who don’t fulfill their obligations since nobody likes their pockets to be affected. However, on repeated occasions, for whatever reason, many taxpayers are sanctioned.

Understanding the IRS interest system is not as complicated as you may think. Here you can find key information.

Types of IRS infractions

Contents

Although it is known that the IRS imposes interest as a form of penalty, before knowing what the amount of that penalty is, we must know when we are in default and what are the types of infractions, since the calculation of our penalty will depend on it.

Each case is different, and you could pay interest for the same reasons for which another person is exempt (if they present a justifiable cause for the breach of it). However, for a better understanding of how IRS interest works, we can classify infractions into 4 groups: Failure to pay, Failure to file, Dishonored Check, Failure to pay proper estimated tax.

Failure to pay

We must be vigilant and remember that one thing is to declare taxes (file your returns) and another is to pay the amount that is owed.

The deadline to make payments is generally April 15th and if you don’t make the payment by that date, you will have to pay interest on that debt (this translates into a penalty or sanction).

Remember that even if you have requested an extension, the payment deadline remains. The extension only works to file your tax return, not to pay.

There are two infractions within the payment default:

- Failure to pay tax reported on the return

In this case, the interests can vary from 0.25% to 1% depending on your specific situation.

Following the Internal Revenue Code §6651 (a) (2), if by the expiration date you have not paid, you must include on your payment:

- 0.25% of unpaid taxes if you have an approved payment agreement.

- 0.5% of unpaid taxes if you do not have a payment agreement.

- 1% of unpaid taxes if 10 days have passed after you received the notice of intent to levy and you did not make the payment.

- Failure to pay tax not reported on the original return

This is the case for people who changed their original return and have not paid the new taxes in full (which were not on their original return) within 21 days after receiving the notice or demand or within 10 days if the claim and notice amount is $ 100,000.00 or more.

The IRS interest corresponding to these cases is established in the Internal Revenue Code §6651 (a) (3) and is classified in almost the same way as the previous case:

- 0.25% of unpaid taxes, if you have an approved payment agreement.

- 0.5% of unpaid taxes, if you do not have an approved payment agreement.

- 1% of unpaid taxes if you have already received the notice of intent to levy and 10 days have passed without you having made the payment.

Likewise, for each past due month, you will be charged a recurring charge until you pay the full debt.

For each month that passes, you will be charged the corresponding interest until you pay all of your debt or until you reach 25%. The monthly charge is full, even if you pay before the end of the month.

Failure to file

As we mentioned before, the deadline to file your tax return is April 15th. If you do not do it before that date, or even that day, you will be taxed by the IRS interest.

Now, everything changes if you have an approved extension. The deadline runs until October 17th. If that date arrives and you haven’t filed your tax return, you will have to pay a “delinquency penalty”.

The penalty for this breach is usually 5% of the total amount owed, and this same percentage is charged for each month that you delay in the declaration until you pay in full or reach 25% of IRS interest.

If you are late for more than 60 days, the minimum fine is $ 435. Although, it can also happen that the balance of your tax due can also be included in the fine as a sanction. Compare those two amounts, and the lesser is the one you will have to pay.

Dishonored Check

The IRS interest corresponding to this case is established in the Internal Revenue Code §6657 and the amounts are as follows:

- If the payment is less than $ 1,250.00, the penalty amount is $ 25 or the written amount on the check. You will have to pay whichever is less.

- If the payment is more than $ 1,250.00, the penalty amount will be 2% of the total amount written on the check.

This applies to both checks and other forms of payment. For instance: money orders.

Failure to pay proper estimated tax

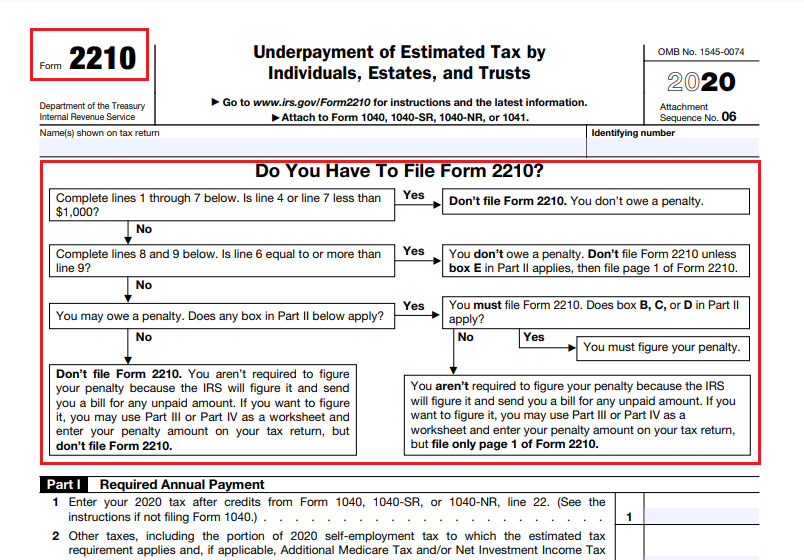

This is the case for people who expect to owe $ 1,000.00 or more during their tax year. When this occurs, taxpayers must estimate the tax to be paid. If you make a mistake when doing the calculation and the result is less than the amount you should have paid, you will have to pay a penalty for underpaying your estimated tax.

The IRS interest is calculated as follows: the number of days late is determined and then multiplied by the interest rate valid for the payment period.

To know if you must pay this penalty, you must check out Form 2210.

Click here to download Form 2210.

Likewise, you can visit this section of the official IRS website for more detailed information on this form.

When does the IRS interest start accruing?

In principle, all IRS interests accumulate daily, but the moment at which they begin to accumulate will depend on the type of offense committed.

- Failure to pay – Dishonored check: interest begins to accrue from the day you received notification of the penalty.

- Failure to file – Failure to pay proper estimated tax: interest begins to accrue from the due date of your tax return.

IRS interest exemptions and reductions

Although the penalties are enshrined in the law and must be met by all taxpayers equally, certain circumstances may excuse you from paying interest on your debt or may even lesser the amount you must pay from the one you were informed of in the notification.

We invite you to review these pages to see if you qualify for an exemption or reduction of IRS interest.