If you are like many people, then a tax refund will be a big deal for you. Paying particular attention to your refund can help you succeed at getting a bigger one.

However, there is always a possibility that you might not get as much tax refund as you expect. There are many reasons for not getting the desired refund. You may have filed with the incorrect status or missed certain deductions or contributions, or other important points.

The problem may be even worse for those who are single and have no dependents. They can only file their income tax returns as single with no dependents and may get the lowest tax returns. Still, there are ways to get a bigger tax refund when the tax time comes.

Continue reading to know how you can get a good tax refund even with no dependents

Tips to consider to gain a better tax refund

Contents

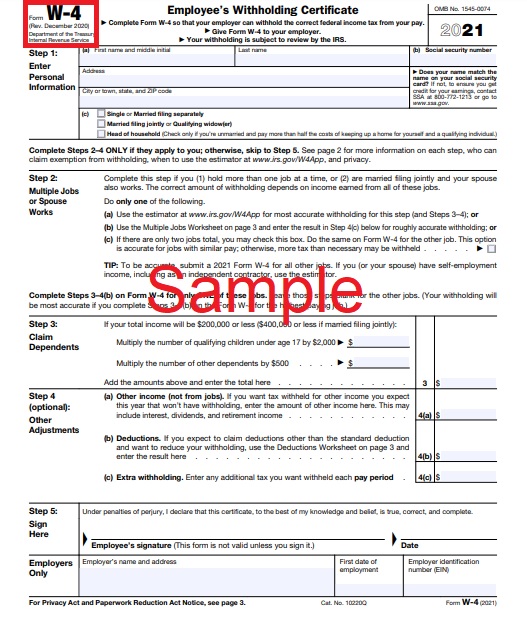

Make changes to your withholding in Form W-4

When you started working as an employee, you probably had filled a Form W-4–Employee’s Withholding Certificate. The way you fill this Form defines what amount of money will be withheld from your paycheck for various taxes such as federal income taxes, Social Security, and Medicare.

One way to get more tax refunds is to withhold more money from your paycheck on Form W-4.

To do this, here are some ways:

- Check the single status in box 3

- Reduce the number of allowances you claim in box 5

- If you claim single and no allowance, your employer will withhold the maximum amount from your paycheck. If you still want to take out more money, you can write down the specific amount in box 6.

- However, if you withhold too much amount, your monthly budget can be tighter than expected. So, fill it carefully to not disturb your monthly planning.

- Sign and date your W-4 Form and check your paycheck to confirm the changes.

➡LEARN MORE: How much does an Employer Pay in Payroll Taxes?

File your tax return

Calculate your federal tax return using the standard deduction and itemized deduction method. Now, use the method that puts you in the lowest tax obligation. The standard deduction method is easier.

The standard deduction for singles is $12,400 in 2020 and $12,550 in 2021. If the itemized deductions are more than $12,550, your taxable income will reduce, and your tax return will increase.

Also, keep track of deductible expenses. The deductible expenses include charitable contributions, home mortgage interest, unreimbursed employee business expenses, educator expenses, student loan interest, contributions to a retirement account, Medical and Dental Expenses, Income, Sales, and Property Taxes.

These deductions can further reduce your taxable income. Even the smallest deductions add up to a significant amount over the year.

Fund your qualified retirement accounts

Try to fund your qualified retirement accounts as much as possible. Investing in such plans drastically reduces the employee’s income tax liability by reducing the taxable income.

Invest in your traditional individual retirement accounts and take full advantage of pre-tax benefits programs (such as flexible spending accounts) offered by the employer. The main reason for emphasizing investing in a pre-tax benefits program is that every dollar spent on such accounts is not liable to any tax.

This will help you lessen the income on which you have to pay tax. Moreover, it can also drop you to a lower tax bracket because of low taxable income.

As a result, the less money you paid as taxes in the year, the bigger the tax refund you will receive.