Throughout our lives, and depending on the jobs we have, we contribute to Social Security aspiring for benefits when we are seniors. Thanks to all the work we did in our youth, we will receive our retirement benefits. However, a very common question is whether we should pay taxes on our social security benefits after age 66?

The answer to that question is: it depends. It depends on whether you’re still working, you’re married, or if you receive other income.

If you want to know more detailed information about whether you have to pay taxes on your social security benefits, keep reading and find it out.

Retirement Benefits

Contents

The Social Security benefits after 66 are part of retirement benefits and almost all Americans aspire to receive them after retiring. As you read above, if during your working years you paid Social Security taxes, little by little, you have been accumulating “credits” towards Social Security Benefits; depending on the numbers of credits that you collect, the number of your benefits will be estimated or will determine if you are eligible to receive them or not.

The number of your benefits will depend on many factors, the main one being how much money you earned during your working career, thus, the more income you had, the greater the amount of your benefit.

Another aspect that will undoubtedly influence the payment of your benefits is the age at which you decided to retire. If you plan to make an “early retirement” (age 62), your benefits will be lower than you retire at age 66. Likewise, if during your career, there were times when you did not work (for any reason), it could also affect your Payments. The amount could be less than the amount you would receive if you had worked steadily.

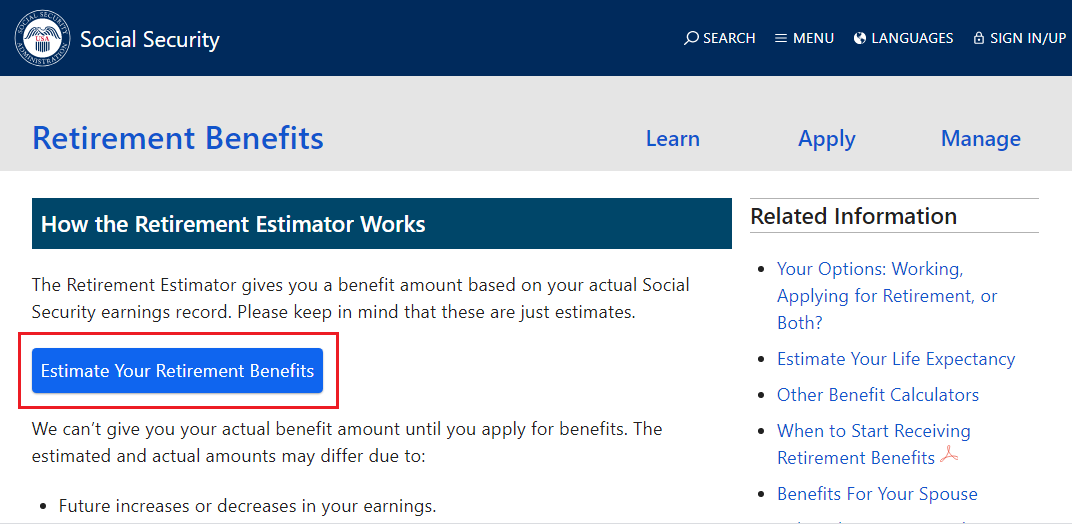

In any case, you can use this tool and estimate what you could receive.

Surely, you have an acquaintance that already receives these benefits and has given you some advice, which can certainly help you. But regardless, we recommend you evaluate your particular case and before deciding to retire, ask for advice; consulting someone specialized in retirement benefits is a good option because even the month you decide to retire can influence the amount you will receive.

With that being said, another thing you should take into consideration when planning to retire is what are the tax regulations related to social security benefits after 66.

Understanding Taxes and Social Security Benefits after age 66

Once you reach the age threshold to receive retirement benefits (66), the amount you receive, at first, will be tax-free. Everything will depend on whether you continue working or have other income. Consequently, you will have to pay taxes on a percentage of the total amount of your benefits.

Seniors who are 66 or older receive full Social Security retirement benefits and, if it is the only income they have, they do not have to pay any federal tax. However, some states do tax Social Security income, such as:

- North Dakota, Vermont, Minnesota, and West Virginia (they apply the same tax rules as federal taxes).

- Rhode Island, Montana, Connecticut, Missouri, Colorado, Utah, New Mexico, Kansas, and Nebraska (the federal tax rules also apply but they offer exceptions or deductions based on your income or your age; so even if you have to pay taxes, the amount may not be that high or you would not have to pay taxes for the total of your social security benefits after 66).

Things change when you receive Social Security retirement benefits and you’re still working. The Internal Revenue Service (IRS) used to establish the thresholds or limits of income of all taxpayers to know what type of taxes and the amount that they have to pay as the case may be.

In the case of seniors who receive the Social Security retirement benefits and also receive a salary or other income including tax-exempt interest income, at the time of filing their taxes they must add all their income plus half of the retirement benefits that are received annually and compare them with the IRS thresholds and thus know whether or not they should pay taxes.

There are two circumstances in which you can pay taxes on these social security benefits:

- Individuals: The limit for the 2020 tax return can be $ 25,000 or $ 34,000. If your combined income is $ 25,000 or less, you will be taxed 50% of your benefits. Instead, if your combined income exceeds $ 34,000, the IRS will tax 85% of your benefits.

- Filing jointly: In the case of married seniors, for tax purposes, the spouses’ income is counted as part of the taxpayer’s annual income. This means that even if you are not working and you and your spouse file a joint return, your income must be counted as part of your annual income and added to your Social Security retirement benefits. If your combined income is $ 32,000 or less, you will be taxed for 50% of your benefits and in case your combined income is more than $ 44,000 per year, the tax will be 85% of your benefits.

How to pay your taxes on Social Security Benefits?

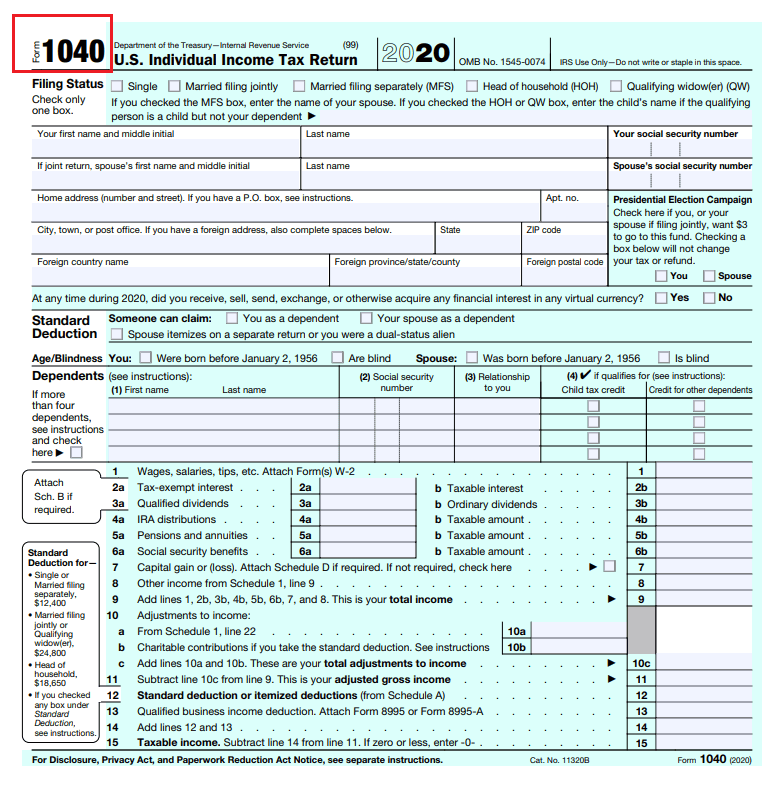

There is no difference between paying taxes for social security benefits to regular income taxes. The only difference is that the IRS only taxes a percentage of those benefits. Generally, the deadline to pay taxes for the previous tax year is April, 15th. However, this year (2021), the IRS extended this deadline to May, 17th.

The form you must use is 140, which you can download here.