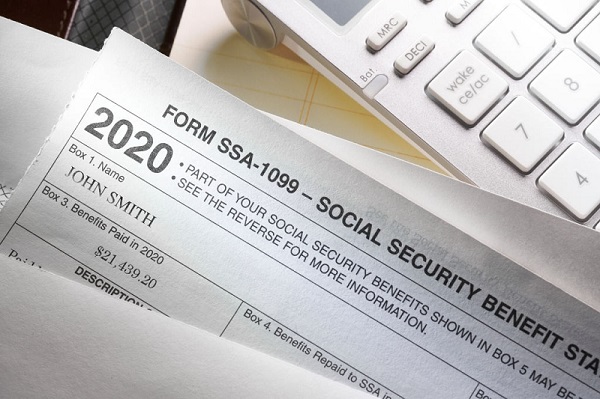

Many Americans ask the question, ‘whether their social security benefits are taxable or not?’ The answer is yes. You have to pay taxes on social security at the federal level.

However, it applies to only those retirees whose total income from several sources such as part-time jobs, pensions, investments, etc., cross a certain threshold defined in tax laws.

Although, you don’t have to pay taxes on your entire benefits. Instead, it varies depending on your total gross income. Sometimes, you have to pay tax on 50% or sometimes even less than that. Maximally, you have to pay tax on 85% if your gross income crosses all the thresholds discussed below!

Keep reading the article, and we will tell you the tax scheme of social security for different income thresholds. Besides, we will also discuss the case for single tax filer and joint tax filer separately. In the end, we will tell you how you can calculate your taxes on social security benefits now!

Quantity of Social Security Benefits Taxes

Contents

Before discussing the tax scheme, you should keep in mind that this is based on your combined income from all the sources after retirement. So, if you are earning money from any investment, part-time job, or any other source, you should add it to calculate income tax on social security benefits.

Individual Tax Filer

If you are a single or married person filing tax returns ‘individually,’ your benefit tax will be based on the following two points!

- If your combined income falls between $25,000 to $34,000 yearly, you have to pay tax on 50% of social security benefits. Keep in mind that you don’t need to pay tax for your entire gross income. Instead, you just have to pay tax for benefits.

- However, if you earn more and your income exceeds $34,000, up to 85% of your benefits are taxable.

➡LEARN MORE: 3 Tips for Transferring Money from a Joint to an Individual Account

Joint Tax Filer

If you are a married couple filing tax returns ‘Jointly,’ the tax rates on benefits will be different for you. You should check the points below to calculate tax as a joint tax filer now!

- If you and your partner’s combined income falls between $32,000 to $44,000, 50% of your social security benefits are taxable.

- If your combined income from all the sources goes above the $44,000, you have to pay income tax on 85% of the social security benefits.

However, if you have very little income other than the benefits, you don’t need to pay any tax. Instead, you don’t even need to file a tax return statement.

Bottom line

If you are a retired individual in America receiving social security benefits, you have to pay an income tax. The tax amount depends on your gross income threshold and how you are filing the tax returns—individually or jointly. You can go above and check all the scenarios for income tax on benefits now!