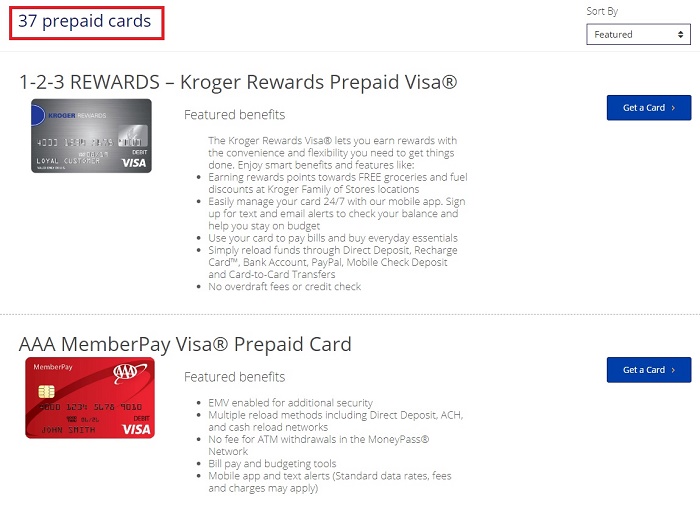

Most often, when a buyer demands the sales tax exemption on products, it can be very problematic for sales and customer support teams. A lot of time gets wasted just to collect the correct documentation from the buyers. A resale certificate is a great example of what you should use in these situations.

The biggest reason is that the buyers don’t understand what documents are required to claim the sales exemption, and they end up submitting the wrong piece of information.

This creates a constant process of submitting the documents again and again until they submit the right papers. Therefore, you must know beforehand how you can claim for sales tax exemption.

To solve this confusion, here is a simple guide to help you know all the important details on the use tax exemption or resale certificate.

What are use tax exemption/resale certificates?

Contents

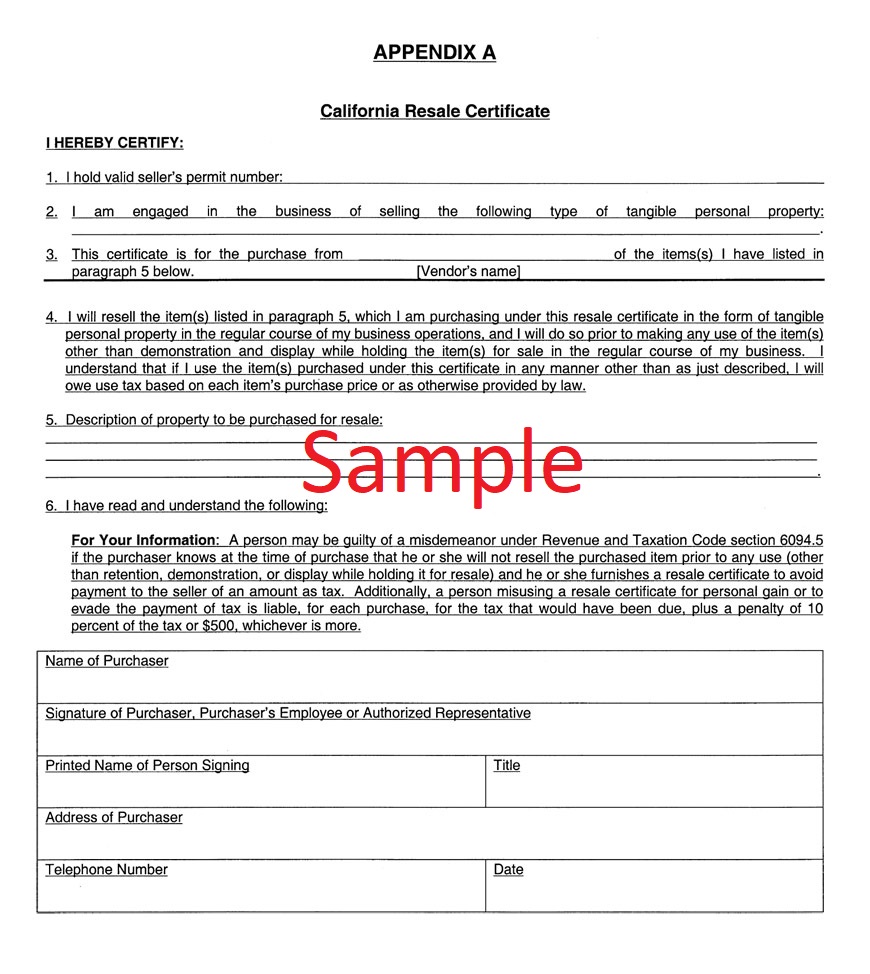

A resale certificate is a signed document acceptable for the sales and uses tax. It indicates that the purchaser intends to resell the goods. Usually, the retailers provide this document to wholesale dealers to claim tax exemption.

Additionally, manufacturers of goods also grant resale certificates to material suppliers. In this way, the certificate becomes a part of the products they manufacture.

The certificate applies to all the items that the reseller purchases from the vendor. As a result, it is provided in the “blanket form.”

The registered business for sales and use tax can use the resale certificate when the merchandise is purchased only with the intent to resale. If a business is purchasing the merchandise intending to use and consume the goods in business conduct, you cannot use the certificate.

What happens if the certificate is Multijurisdictional?

If the resale certificate is multijurisdictional, it means that it can work in various states. Using a multijurisdiction certificate, the reseller can purchase the taxable products or services claiming tax exemption from the seller located in any of the states listed on the form.

It is advantageous for the buyers or companies who work in multiple states, thus eliminating the need for submitting dozens of certificates to vendors. However, the guidelines may vary from state to state regarding the form; therefore, it’s better to look for the state laws in which you are working.

To know whether it is eligible in a state or not, you should contact the department of the revenue of the relevant state, or do a Google search to see the state’s guidelines.

Some states accept Multistate Tax Commission’s Uniform Sales & Use Tax Certificate – Multi jurisdiction Form, while others accept Streamlined Sales Tax Exemption Certificate.

➡LEARN MORE: Is Adjusted Gross Income the Same as Taxable Income?

Validity of the Form

The resale certificate is valid only when the following elements are stated on the form:

- Name and address of the purchaser

- Name and address of the seller

- Registration number of purchaser

- Description of property/merchandise purchased for resale

- Purpose of exemption

- A statement that if the property /merchandise is used in a taxable manner, then the purchaser will remit the consumer’s use tax

- Date, Signature, and Title of the authorized individual at the purchaser

Your resale certificate may expire. You must update your certificate regularly to avoid any inconvenience. Still, after updating the certificate, you must keep the previous certificate as you may require it for the audit process.

Difference between Resale Certificate and Resale License

You may confuse a resale certificate with a resale license. There is also a considerable difference between a resale certificate and a resale license.

The resale license is issued to businesses and individuals who sell the services or goods subject to sales tax. Whereas, a resale certificate is issued to suppliers, and it also includes a spot for the license number.