Using non-profit funds for personal expenses is something you should be careful about if you’re running this type of organization. A non-profit is a business like any other. As such, it has expenses to meet, salaries to pay, and regulations regarding the use of restricted funds they’ve received.

It is critical to manage wisely the organization’s financial resources. The Board of Directors should always evaluate any money outcome with the utmost detail. Sometimes trying to do a nice deed can end up in a legal situation that could have been avoided.

In that sense, here are a few things you should consider when handling funds in this kind of organization.

Types of funding in Non-profits

Contents

It is imperative to understand that a non-profit organization gets its income from fundraising, donations, and other types of aid.

Therefore, if you are in charge, you can spend the funds depending on how you received the money.

If the designation was solicited, meaning that you requested it through an event, article, radio or website, it should only be spent for the purpose it was asked for.

But, if you received a donation that wasn’t requested, the Board of Directors can use it as it deems necessary.

In that sense, we can talk about two types of funds:

Restricted funds

As the name suggests, these are the funds that the organization cannot spend on anything but their intended purpose.

Commonly the donors, funders, or whoever gave the money to the non-profit are the ones who determine for what end it may be used.

Also, we can categorize these funds in two types:

- Temporarily restricted: You can use them for different purposes after a certain amount of time or after completing the project.

- Permanently restricted: You cannot use them for anything else besides the purpose of the donor.

Take into consideration that using non-profit funds for things like “borrowing money” can cause the donor to take legal actions against the organization.

For that reason, even if you consider it a loan or you plan to return the money, it is still illegal.

Unrestricted funds

The organization can use these funds for whatever purpose the Board of Directors considers proper. Typically, they use it to cover day-by-day operational expenses.

Reporting a Non-profit Expenses

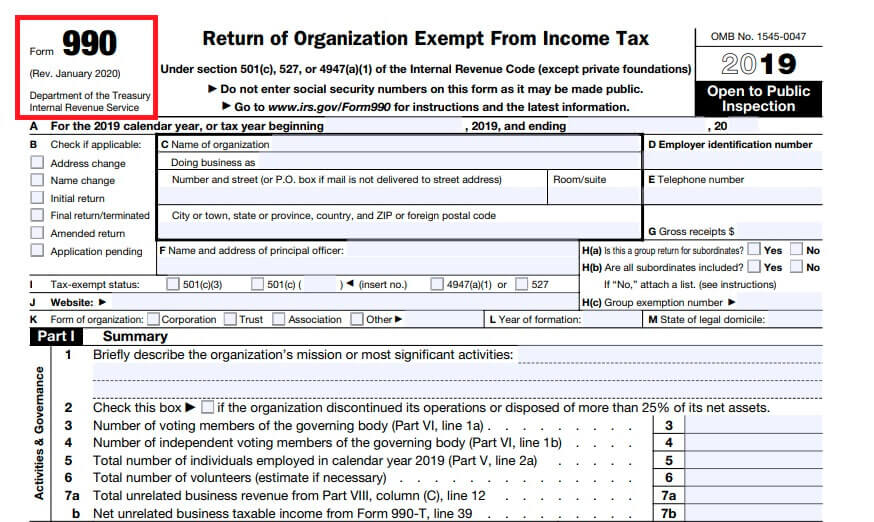

According to the Internal Revenue Service (IRS), all the tax-exempt non-profit organizations classified as 501(c) are required to file the Form 990 to provide information about their annual expenses.

The IRS asks for this to evaluate if the tax-exempt organizations are using their resources appropriately; thus, they have to report their overhead expenses and their program expenses.

This way, they can see how much you are investing in fulfilling the non-profit’s mission and for operational costs.

If the overhead expenses are too high, and the programs developed by the organization do not match with its mission, they can be subject to an audit and get harsh consequences.

Many experts recommend that non-profit organizations destine most of its funds to program expenses and less in overhead ones.

This obeys the fact that donors prefer to fund non-profits that use their resources to create help rather than to spend in their own executive’s compensation.

At the end of the day, organizations should balance their funds, prioritizing carrying out their mission of creating programs without losing sight of their overhead investment.

➡ If you want to know more about the tax-exempt organizations, we recommend you to read this article: How to start a 501c3 and Types of Organizations

By now, you should know that profiting non-profit funds for personal expenses is a big NO. Also, using restricted funds for any purpose that wasn’t the initial one is another big NO.

If you’re running an organization of this kind, you should provide appropriated disclaimers when raising funds, specifying that any remaining money of its primary purpose, will be used for overhead expenses

Likewise, if your non-profit received a donation for one purpose and the board must use that money for other reasons, you can ask the donor to allow the organization to repurpose the funds.

They can legally decline, but if you present a good case, you might get lucky.

Keep in mind that it is not easy dealing with an organization finances. But if you do it correctly, with transparency and manage to balance incomes and expenses, you will be just fine. I I I I