Creating a non-profit organization, whatever its purpose is, takes a lot of work. However, one benefit you can receive is the 501c3 status for tax exemption.

The Internal Revenue Code (IRC) of the United States provides this condition and gives the possibility to not pay taxes to organizations focused on serving the community.

In this article, we will guide you step by step through the types of organizations, how to create one, and how to apply for this status.

Requirements to start a 501c3

Contents

Before thinking about how to get a 501c3 status, it is essential to know where this classification comes from and what it means within the Internal Revenue Code (IRC):

- 501: This section establishes which organizations may be exempt from contributions.

- c: Subsection (c) lists 28 types of entities and their conditions.

- 3: Subsection (3) classifies these entities according to their purpose: charitable, religious, educational, or cultural.

Now, it is important to clarify that it is not mandatory to have a tax exemption for a non-profit organization to function, many of them do not have it and have been offering their services for years. This is only an extra support.

However, those who request it have more opportunities to get funds for their projects.

To qualify, you will first need to create and register the organization, and then fill the application for the tax-exemption if you complete the requirements of the internal revenue code 501c3:

1. Select your purpose

To apply for the tax exemption, you will have to select the purpose of your organization; this refers to the main objective for your work, the reason why you founded it. And, it must correspond to one of the categories described in section 501c3 of the IRC.

2. Choose a structure

There are three basic structures: a corporation, an escrow or a civil association, and the most common for a 501c3 is the first one. However, you should study your options very carefully before making a decision.

3. Decide the name

Before registering your organization, choose an acceptable name, and be sure that no one is already using it.

4. Create the board

Board members are the ones who lead the team and make important decisions. They must be natural persons and do not need to live in the same state where the organization is. Be sure to choose trustful people who have the same goals as you, this way, they will easily identify with the non-profit.

5. File your Article of Incorporation

This includes basic information about the organization and is filed online or in a state agency.

The documents and process may vary depending on your state. Click here to see more about each one.

6. Pay the filing fee

You will have to pay a fee when submitting the Article of Incorporation, which also varies by state. For example: In Texas, the fee is $ 25, but in Oregon, it is $ 50.

7. Request your 501c3 status

To apply for the tax-exemption, you must do it after 27 months from the legal constitution of the organization. Then you can follow these steps:

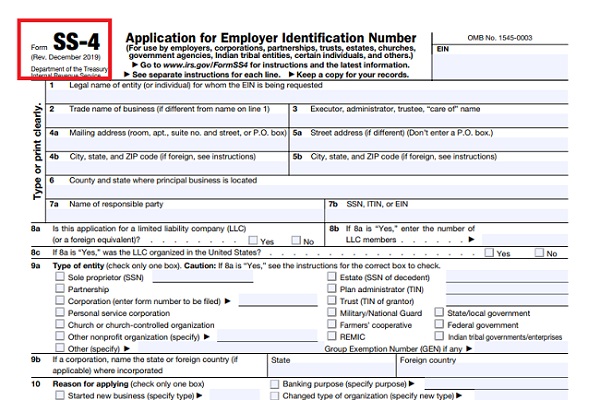

- Request your Employer Identification Number (EIN). To request it, complete Form SS-4 and submit it online through the official website. Do not start this process until your organization is registered in the state.

Also, if you need more information to understand the EIN, you can read here.

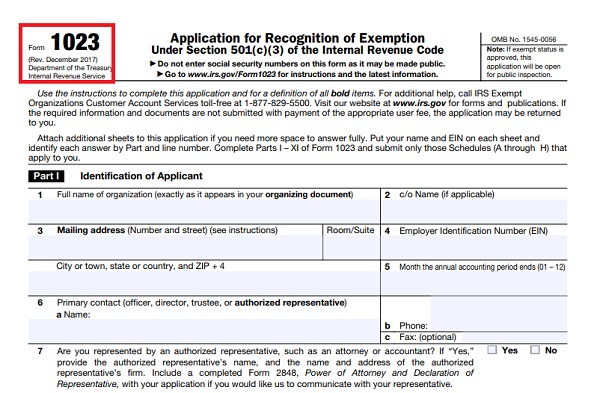

- Complete Form 1023. This is the primary document to request the tax-exemption. For more details about this step, keep reading until section “501c3 form download”.

- Pay the user fee. After completing Form 1023, you will need to file it and pay the “user fee.” The amount will depend on your organization’s gross annual income.

If they have exceeded or will exceed $ 10,000 annually over four years, the user fee will be $ 850. On the other hand, if you have not reached this sum, the value will be $ 400. - Receive the determination letter. Once a tax specialist confirms that your organization fulfills the requirements, the IRS will send you a determination letter. This is an important document that you should keep with the rest of your permanent records.

➡ LEARN ALSO: Ways to find out if someone filed taxes on you name

501c3 form download

According to the IRS tax code section 501c3, to apply for this status, you must file the 1023 form. This document is the most important since it summarizes the purpose of your organization and if it qualifies for the exemption.

You can get it online here: https://www.irs.gov/pub/irs-pdf/f1023.pdf (complete from part 1 to 11, and any required appendices).

But we also recommend you to read the instructions first: https://www.irs.gov/pub/irs-pdf/i1023.pdf

Types of 501c3 organizations

Within the 501c3 status, there is another classification that determines what kind of organization you have:

- Public Charity: It is the most common and in which most people volunteer. Also, they generally receive support and donations directly from the public. Some examples are animal care, churches, and education programs.

- Private Foundation: In general, it does not have activities or programs since its income comes from a small group of donors (either from companies or individuals) to help other groups.

- Private Operating Foundation: Although it is the least common, it is a mixture between the first two: it does have regular activities and also receives private donations.

How long does it take to get a 501c3

Most organizations have to file the tax-exemption 27 months after the legal constitution. Then, the IRS takes from 2 to 12 months to decide on your application.

If you file late, you will need to complete Appendix E, which is part of Form 1023. This will help the IRS to determine the effective date of the exemption. I I