At first, it is difficult to find a clear difference between “Charitable” and “Social Welfare” organizations, that is why it becomes challenging to know which one to choose. However, if you compare them, you will find some distinctive features.

The former is categorized in section 501c3 and the latter in 501c4 of the United States Internal Revenue Code (IRC). Also, both can apply for federal tax exemption.

Below you will find a series of distinctions between these two nonprofit organizations to help you understand them better and know how to apply for each one.

Definition of 501c3 and 501c4

Contents

In the United States, nonprofit organizations had their origin more than 80 years ago. Since the creation of the tax legislation, these organizations are codified as “501c”, and they are mainly regulated by the Internal Revenue Code (IRC).

Currently, there are over 30 different classifications for 501c organizations, but we will focus on 2:

Charitable organizations, created with the purpose of contributing to issues such as religion, charity, education, literature, public safety, sports competitions, protection of minors, or animals; these are exempt from income taxes according to IRC Section 501c3.

On the other hand, a Social Welfare (which qualify in section 501c4) include groups like associations of homeowners, civic leagues, fire volunteers, groups of employees, among others. These provide social benefits for their communities, but they do not meet the requirements of section 501c3.

Both types of organizations are exempt from federal income tax.

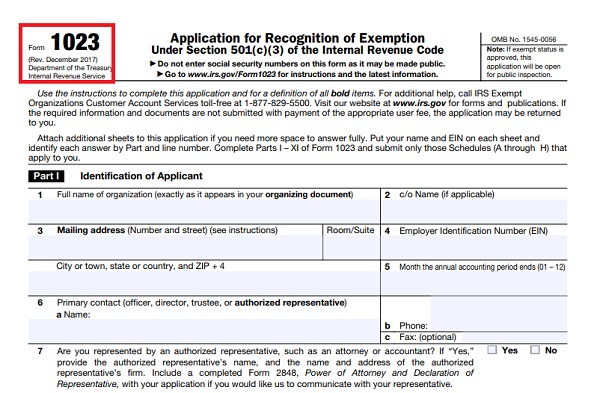

501c3 charities (except churches) must apply to the for the exemption by filing Form 1023 or Form 1023-EZ to the IRS.

➡ If you want more details about this procedure, read here: How to start a 501c3

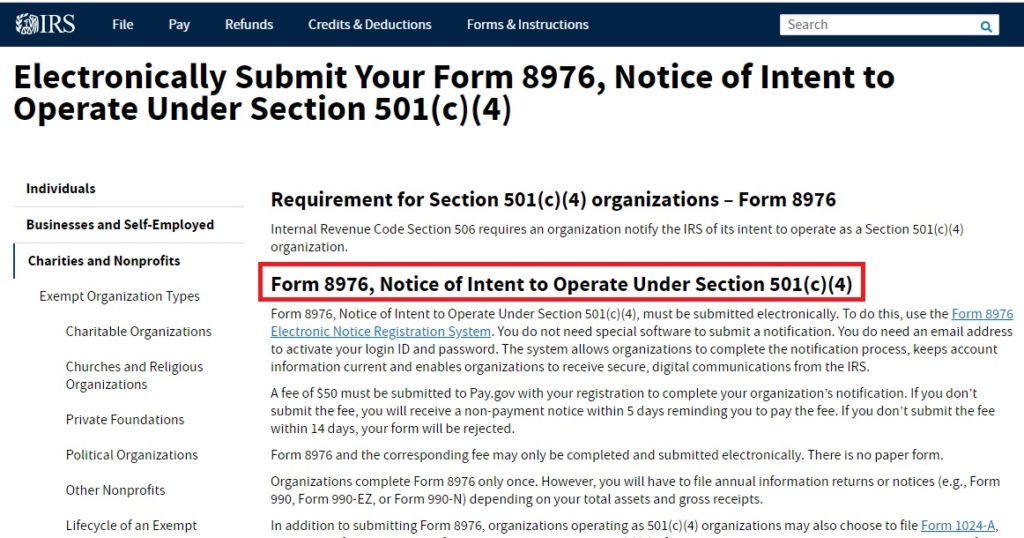

Instead, a social welfare may request formal recognition of the exemption to the IRS, within 60 days of its creation, by electronically submitting Form 8976.

501c3 restrictions

If you run this kind of organization, the main restriction is that you cannot use its profits, in any way, for the direct benefit of an individual. Only those who work in the organization may receive payments, but under the concept of salary.

Also, one of the most striking differences between a 501c3 organization and any other commercial company, is that in companies, shareholders can divide their profits; on the contrary, a 501c3 organization cannot participate in a profit-distribution of any kind.

In case that this type of organization ceases to function, it cannot inherit its assets to any member of the organization; they must give it to a foundation.

Regarding lobbying activities, they must be less than 20 percent of its total operations.

501c4 restrictions

Like the previous case, 501c4 nonprofits cannot use the organization earnings to benefit any of its individuals directly.

Also, these types of organizations cannot express support or rejection for any particular political party or politician.

You can participate in lobbying, political meetings, and other events of this kind only to help achieve the social welfare goals. Still, these cannot become the primary function of the organization.

Considerations for political participation

It is important to note that, unlike 501c3 organizations, the 501c4 status has a much broader range of political participation. This allows them to enjoy their tax exemption and, at the same time, participate in lobbies, political campaigns, and other activities in favor of the social well-being of their community.

However, it is crucial to keep in mind the various considerations, prohibitions, and requirements to avoid the cancellation of tax-exemption.

If there is any problem when starting (or once created) any of these entities, it is essential to contact a lawyer who can identify complications and reduce risks promptly.