Throughout our lives and for many legal procedures we will need a document that proves our income, either to buy a house, a car or request a loan at the bank. This is very useful to demonstrate our ability to pay; we just have to show our paystub and that’s it. But what happens when we don’t have it? How else do we test our income without a paystub?

It is important to remember that there are other ways to prove that you have financial capacity based on your income even if you do not have your paystub, so do not be alarmed. Lenders may accept other proof of income for you.

Here, we have written a guide so that you can apply for that credit or apply to rent an apartment.

What is a Paystub?

Contents

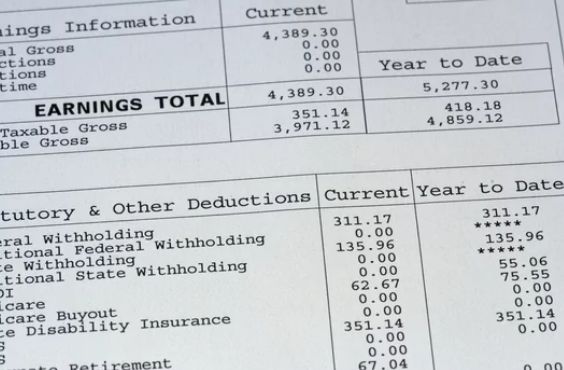

It’s also called “payslip” or “paycheck stub” and it is a document that contains detailed information about an employee’s wages and deductions for a specified period of time. That is, it includes the number of hours worked, the taxes, and the type of earnings; it is the typical proof of a person’s income.

In simpler words, it is a document that serves to know the amount of income that a person has in exchange for their work and the information relevant to the calculations of that income (deductions and worked hours).

What are Paystubs used for?

Its main objective is for the employee to verify the details of their payment since, in it, she or he can verify the calculations that their employer made to estimate the wages. In this document, employees know the rationale for the salaries they receive and additional deductions and bonuses if applicable. But it does not only serve for that, there is much more.

Proof of income is almost always required by landlords and lenders to verify that the person with whom they are entering into a loan agreement or credit contract has the economic capacity to effectively respond for that money to which they are agreeing to pay. They generally ask for the last two paychecks and do the calculations based on that.

But this is where the problem occurs, what if you have not worked the hours that you regularly work in the last two months and that is why your income has decreased? Or what if your employer does not give you this document? Or even, what if you are not an employee but the owner of a business and you do not have paystubs?

Do not be alarmed if your current situation is framed within these questions, as we mentioned above, you can legally prove your income without this document.

Other documents to prove your income

There are several circumstances in which you can prove your income without a paystub even if you have it or not. It may be the case that you actually have it, but the procedure that you are going to carry out requires another type of documentation. Or if on the contrary, you do not have it, there are other ways to do it.

For your convenience, below we will explain how to prove your income without paystubs depending on your specific situation.

Employees

If an employer does not give you your paystubs, the first recommendation we make is that you talk to him or her and ask them to give you your paychecks. If this does not work, these are the documents you can use to prove your income:

- W-2 Form: You can use this form if your income has not changed much since the last tax season, because in this document you can verify the information about your deductions, exceptions, exemptions, and other things. But, if you have changed your job or your income has changed significantly (increased or decreased) since the last tax season, you cannot use it.

- Offer Letter: Another option you have at your disposal is to show your possible landlord or lender, the offer letter from your new job. Commonly, this type of document establishes the salary you will receive. If you wish to use this document, you can tell your landlord or lender that they can verify this information by contacting your employer.

- Bank Statements: You can show your bank account balance as well. Although it may not be so formal and does not guarantee that every month you will receive an average amount of money, your prospective landlord or lender can verify that you do indeed have income in your bank account regularly.

Business Owner

In these cases, the option to prove your income without a paystub may be a little easier, and the fact that you are your own employer helps. You have 2 options:

- W-2 Form: The same as the previous case, you can only use it if your income has not changed drastically from the previous fiscal year.

- Bank Statements: Offer to show your account statements to prove you have a steady income as a business owner. You may also show the documents that prove you are effectively the owner of the business, such as articles of incorporation.

Although in this article we refer to how to prove your income without a paystub, as a business owner you can generate your own paychecks and submit them.

Independent Contractor

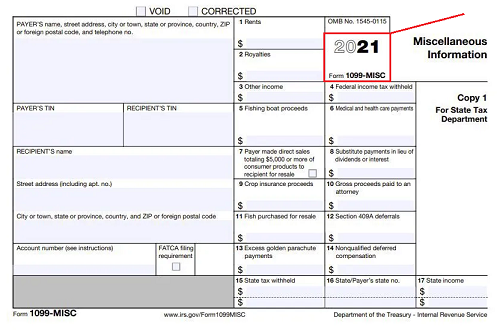

If a company has hired you as an independent contractor, it is very unlikely that they will give you a pay stub or paycheck at the time of payment. So the option you have to prove your income is the 1099 Form.

When a company hires an independent contractor, it must fill out a 1099 statement, which is a tax form that records the income of these types of people. So you can use your 1099 Forms from the past three months to prove your income.

READ MORE: Section 8 program

Retired People

For retired people, providing proof of income may take a bit more effort since retirement income comes from many sources. For instance: pension distributions, Social Security benefits, veteran’s pension, and more.

If this is the case, all you have to do to prove your income without pay stubs is collect all the documentation of your benefits. Each retirement benefit has its own documentation that proves you are a retiree and receive funds for that. You may write a letter of income and attach your documentation and show it to your landlord or lender.

Unemployed People

When your prospective landlord or lender asks you to prove your income, they may use “proof of income” instead of “proof of employment” for several reasons. First, it is considered discrimination to require proof that you have a job, and second, you can legally earn an income without actually working.

If you are unemployed, you can prove your income with your bank statements or with the documents of any subsidy or compensation you receive. It does not matter if they are benefits from the government or any other entity, all the documents that show that you are a beneficiary and receive income for that will serve as proof of income.