Perhaps the first question that arises when we want to know if someone filed taxes on our behalf is, why would someone do this?

Generally, it could be a mistake, an accidental fact. However, in many cases, this is done by criminals to collect fraudulent refunds through the identities they steal.

This is a reality that thousands of people suffer annually. In 2018, the Federal Trade Commission of the US received nearly 40,000 reports of identity theft for tax fraud. If you want to know more about this subject, keep reading.

Ways to find out if someone filed taxes on you name

Contents

IRS Notice

The most common way to find out if someone else filed taxes in your name is when the Internal Revenue Service (IRS) denies your documents.

If the IRS receives two different returns with the same Social Security Number, they immediately reject the second return. Then, they send a notification explaining that a previous return has already been filed with that number. In these cases, they do not give more details about further reasons for the denial.

If this happens to you, and you believe that someone has filed taxes without your permission, contact the IRS by phone at 1-800-829-2410; the IRS staff has the authority to review your current tax return status.

Advisory services firm

Some tax advisers do (under previous contract) specific follow-up to your returns, and can keep you updated at all times.

For example, Jeffrey Craig, senior advisor to financial planning firm The Colony Group in Boston, explains that the firm he represents has systems designed to identify suspicious returns.

However, since very few people hire consultants in this area, the most common way to know about a fraud on your behalf is the denial notice that the IRS gives to the taxpayers, as we mentioned above.

Remember that, if you ignore this fraud, whoever stole your identity will receive your tax refunds. This is why you have to be cautious about it and, in case it happens, you should go to the IRS as soon as possible to process your actual return.

What to do next?

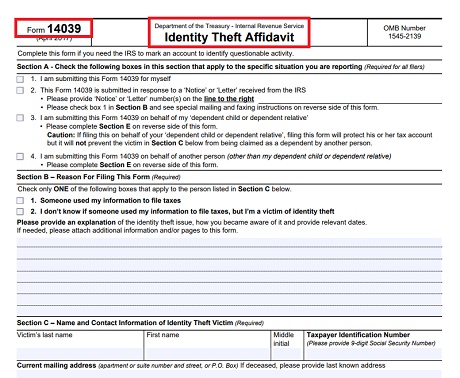

Form 14039

When you are aware of what happened, you must complete and submit Form 14039 to the IRS immediately. The function of this form is to alert the IRS of the other fraudulent presentation, and to initiate the procedure to restore your identity.

You must indicate in the form that someone misappropriated your identity, and caused a problem in your tax account. You will also need to provide all the information for the affected fiscal year and the last return you submitted before the identity theft.

Then, they will send your form to the Identity Theft Victim Assistance office. By the time you complete it, attach a copy of your driver’s license, your Social Security card, and utility bills.

In case you don’t have a driver’s license, replace it with your passport, military ID, or any government-issued ID. If you became aware of the fraud against you through the IRS notification, also include a copy of it.

➡ READ ALSO: Will I get a Stimulus Check if I Owe Taxes

Prevention

Fraudulent tax returns are often a big headache. Although, in most cases, they do not mean that the taxpayer will lose their refund, it is better to prevent it because it leads to a six-month process while the IRS conducts the investigation.

Besides, if someone has so much personal information about you to file a tax return, they can also commit other frauds using your identity. Or, your case may be part of a local fraud scheme.

However, even though there is not a specific pattern in criminals when committing this fraud, there are practices that can help you to prevent the theft, such as:

- Use long, hard-to-guess passwords for anyone other than you.

- Do not show your Social Security card or number to strangers.

- Send confidential information through secure channels.

- Only work with certified tax preparers.

In case of fraud, the Federal Trade Commission suggests filing an identity theft report with your local community police department.

It is clear that the police will not be able to go out to look for the guilty, but it is useful for them in case someone in your name commits another crime.

My accountant notified my, that while attempting to obtain an extension, he was notified that my taxes may have already been filed. I can’t seem to get through to anyone. Can you help me?