When creating a company, keep in mind that you will have to pay taxes. For this reason, the Internal Revenue Service (IRS) assigns each company a tax identification number that helps to differentiate it; the main two are the Federal tax ID number and the State tax ID number.

They have similar functions, and people usually get confused about them; however, they are not the same.

In this article, we will show you the difference between both and how to look up your state tax ID number.

Difference between federal and state tax ID number

Contents

When you own a business, one of the firsts steps you have to complete before operating is to request a tax ID number. The Internal Revenue Service (IRS) provides these numbers, and they function as identifiers for your company when returning taxes.

In the United States, it is mandatory to pay taxes to the federal government and to the state in which you are located; that is why there are two different types of numbers.

- The federal tax ID is also known as Employer Identification Number (or EIN).

It is used to pay taxes derived from your income. However, sometimes you can use your Social Security number instead; for example: if you are the only person owning the company, or if you do not have employees. It is a unique number, and you only have to request it once.

Note that in some states, they do not collect federal income taxes (Florida, Nevada, Alaska, Texas, South Dakota, Wyoming, Washington), so you will not need to request the EIN.

- The state tax ID (also called sales tax permit) is the one you receive to pay specifically for the state taxes where the company legally works.

This means that if your company has a presence in another state (either because you move, open a branch, or distribute products or services), you will have to apply for a new tax ID; your EIN will remain the same.

How to request tax ID numbers?

Regarding the federal tax ID number, we recommend you to read this article, in which you will find the process to get it: How to get an EIN?

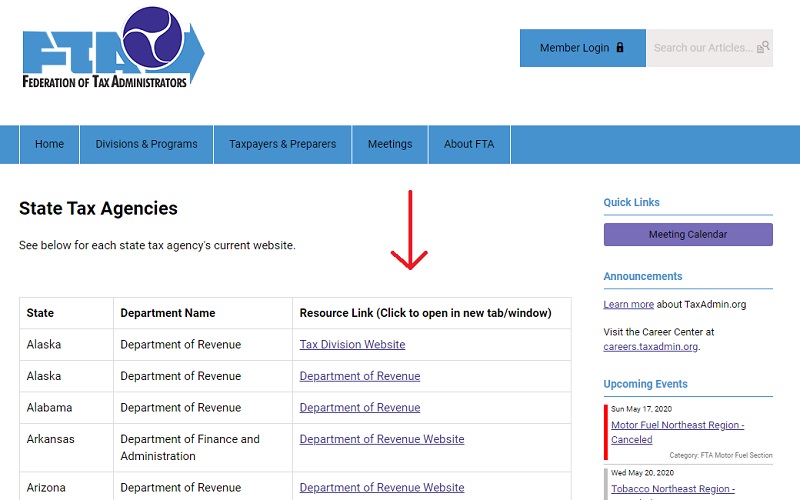

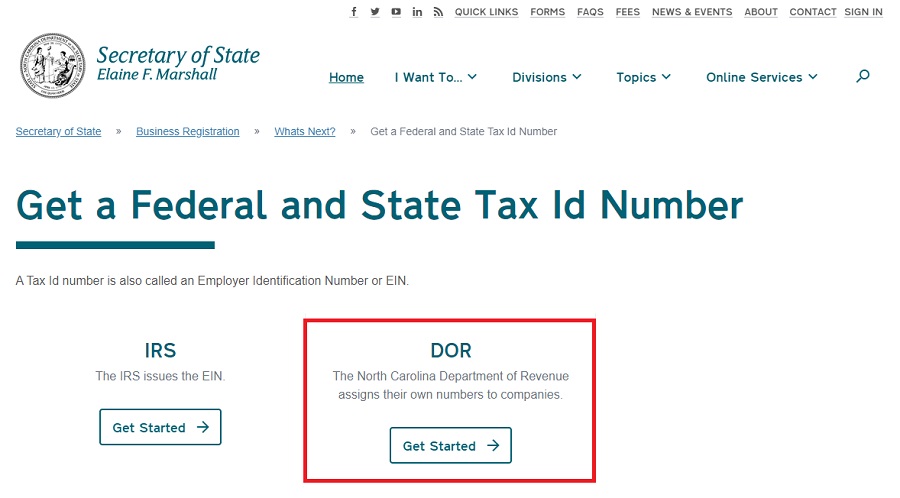

On the other hand, the process of requesting the state tax ID number is different depending on the location. Contact the Department of Revenue of your state and ask them for specific information on this subject.

For your convenience, in this link, you can see the official websites for each state: www.taxadmin.org/state-tax-agencies.

However, by this moment (May, 2020), the offices are closed due to the COVID-19 pandemic.

On the other hand, if you want to see an example, check this link about how to do the requirement in North Carolina: www.sosnc.gov/Guides/launching_a_business/get_federal_state_id.

State ID number lookup

After you get your identification number, sometimes you can either lose it or forget it; so, here are some things you can check to find the number:

- The last tax return from your business.

- The original documents from your tax ID request.

- A company bill.

- The application for your bank account, credit card, or insurance.

- Sometimes even a check can have the number, but that will depend on the type. Actually, when it comes to checks, there are lots of questions when giving or receiving them, especially knowing where can I cash a personal check.

Additional help

If you cannot find information about the process in your state, or you have more questions about it, you can call the IRS free-toll line for Business inquiries: 800-829-4933 (from Monday through Friday, from 7 am to 7 pm).