Nowadays, wire transfers are considered one of the fastest and safest ways to send money to another person. Plenty of people still use checks and deposits, but wire transfers have grown in popularity for how simple they are.

There are numerous apps and online portals to transfer money like PayPal, Venmo, and so on. However, if you use these services, you may have to pay a fee if you want the money to be delivered immediately.

Even though checks and deposits could be easier to use, wire transfers allow you to transfer money without going to a bank institution. You only need to have a stable internet connection, and you will be able to send the money.

Wire transfer duration

Contents

A wire transfer is an electronic way to send money; banks use their internal networks to do this process between each other. Generally, almost all bank institutions use FedWire System, making transfers safe and expeditious.

Usually, a wire transfer can take one or two days to deliver your money. The time depends on several factors; sometimes it can either delay for a couple of days, or be done in less than 24 hours.

➡ READ ALSO: Things you need to know before transferring money

Considerations before doing the transfer

By the time you are transferring money to someone else, you should consider the situations explained below:

The day of the transaction

First of all, the Expedited Funds Availability Act (EFAA) demands all the financial institutions in the US to make wires transfers available to recipients within one business day (from Monday through Friday, except in federal holidays).

Additionally, banks define their own “cut-off times,” which is the limit they establish to receive daily transfers. So, the specific hour when you do the transfer will affect the duration of it.

For example: If your bank’s cut-off time is 5 pm and you make the wire transfer at 6 pm on Monday, the money will be delivered on Wednesday.

Yes, the transfer is supposed to last one business day, but since you made it on Monday at 6 pm, and exceeded the time limit, it will count as if you did it on Tuesday.

Note that if you make the wire transfer on federal bank holidays, the process may delay a few more days.

Location (yours and the recipient’s)

To estimate how long your wire transfer can take, you should also consider where you and your recipient are located.

There are 3 cases to consider:

- Domestic transfers. If the accounts involved in the transaction are both located in the US, the transfer may be completed in one business day (24 hours).

Sometimes, when the accounts belong to the same bank, the transfer is done immediately (it depends on the institution’s policies and its cut-off time).

- International transfers. Currently, due to technological advances, wire transfers from one country to another are possible.

If your account is located in the US, and you send money to someone who has an account in England, the estimated period to receive the money is from 1 to 5 days. It will depend on the bank’s internal networks, the differences in time zones, and the foreign currencies.

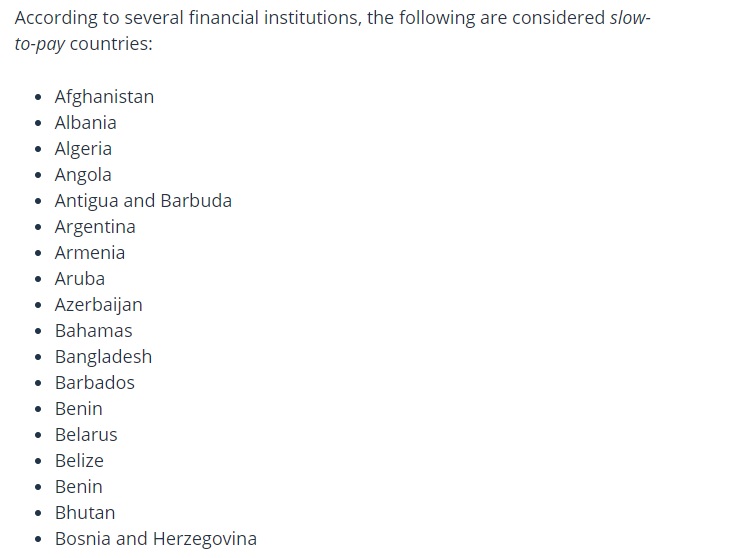

- Slow-to-pay Countries. This term is used when referring to countries that provide a slow delivery time for wire transfers. In these cases, the money may be delivered within three weeks, or even get canceled.

If you need to transfer money to another country, we recommend you to contact your bank and request an updated list of slow-to-pay countries so that you can look for a better option. However, in this list, you can see some of them:

Your bank’s internal network

The system and network that your bank uses can also affect the speed of the transaction. Some may be faster than others, but the intention is to provide an optimal and secure portal.

Commonly, banks use these systems:

- FedWire. It is the most common between US banks, and enable functions such as:

- Transferring large amounts of money.

- Making time-sensitive transactions between national accounts.

- Doing a real-time gross settlement, in which the money is received immediately.

- The Society for Worldwide Interbank Financial Telecommunication (SWIFT). When it comes to international wires, SWIFT is the most used system to deliver money.

If you are sending money abroad, you may need to ask the recipient for the SWIFT Code to complete the process. In any case, bank institutions provide their customers a guidance to make this type of transaction.

Remember that the delivery time will depend on the bank’s internal networks, the time zone, and the foreign currencies.

On the other hand, if you still have questions, you can find more information about wire transfers on this portal from Bank of America: www.bankofamerica.com/deposits/wire-transfers-faqs.