A credit card is a widely used payment tool that allows us to “borrow” money from the bank, pay for items or services we want, and then pay it back with an additional amount called interest.

However, the annual interest rate on credit cards can be high; and, although many people would like to reduce or eliminate this amount of money from their debts, we cannot ignore that they constitute financial assistance for customers.

If you want to be more organized about this subject, in this article, we will show you how to estimate your credit card interest in a very helpful tool: Microsoft Excel.

Previous steps to calculate credit card interest

Contents

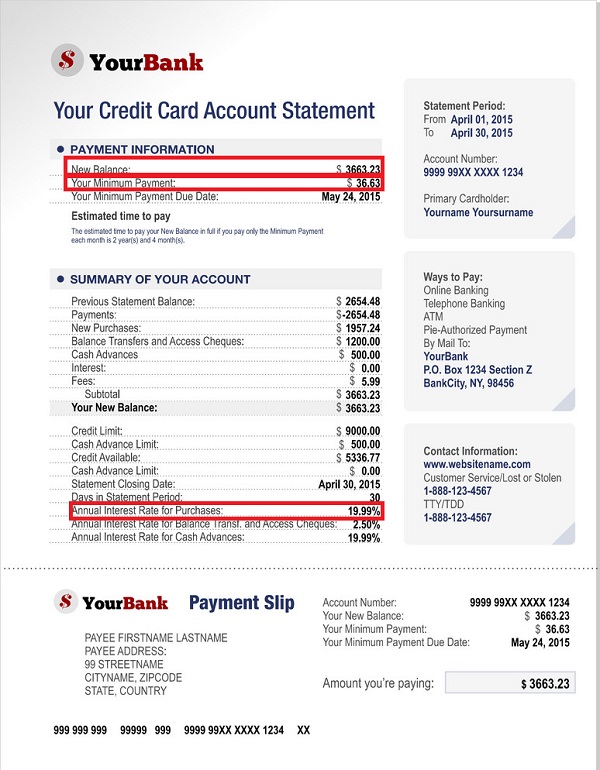

Before creating the workbook in Excel, we recommend you to collect all the financial details of your credit card. Those are the current balance, annual interest rate, and the minimum payment amount. This information can be found at the top or bottom of your most recent account statements.

Currently, banks offer services through their official websites where clients can verify all this information. Although the design might vary depending on the bank, this is how it usually looks.

➡ READ ALSO: Load a Walmart MoneyCard

Using Excel

Microsoft Excel is a very useful tool to solve and calculate any type of mathematical operations, and the interest of your credit card is not the exception. Sometimes we tend to think that is complicated, but if you use the right formula, there will be no problems.

Make sure to have the information described above and follow these steps to create the workbook; the program’s functions will automatically calculate the debt, and you will not waste so much time.

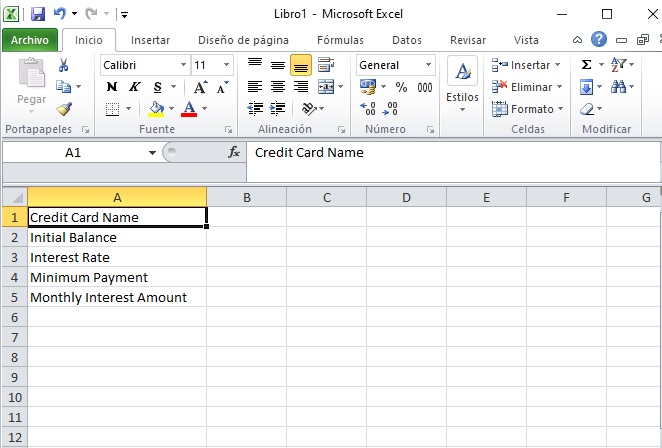

Step 1, open Excel and write descriptions in the cells

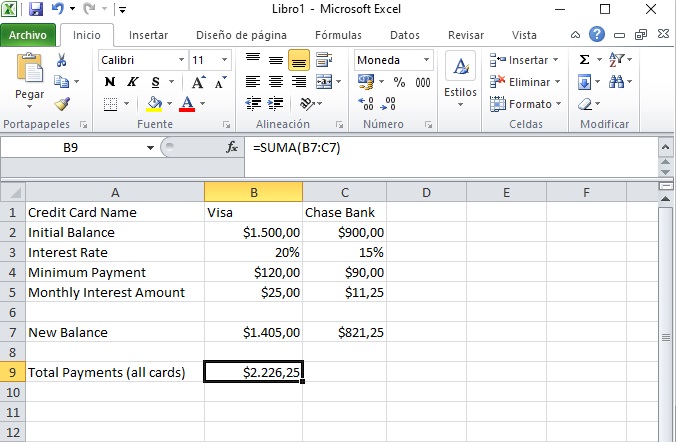

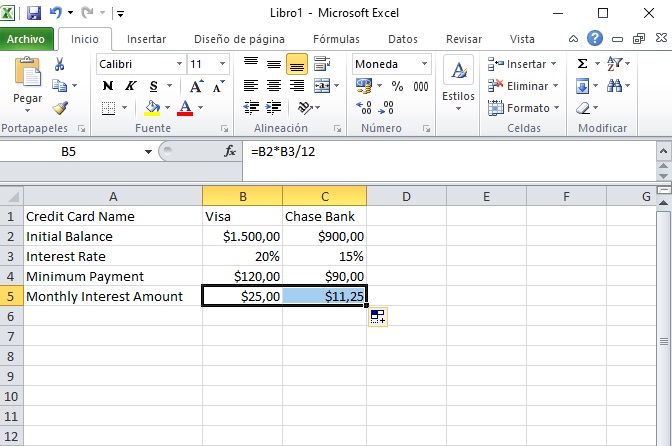

This way, it will be easier to understand the operation and what each cell refers to. From cell A1 through A4, write in the following order: credit card name, initial balance, interest rate, minimum payment, and monthly interest amount.

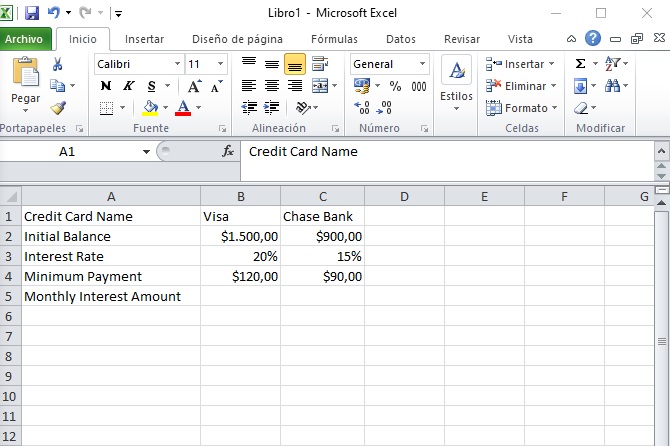

Step 2, enter your credit cards’ information

Use each column for each credit card, starting in B; if you have others use column C, and so on.

In this example, we will write different values for two credit cards.

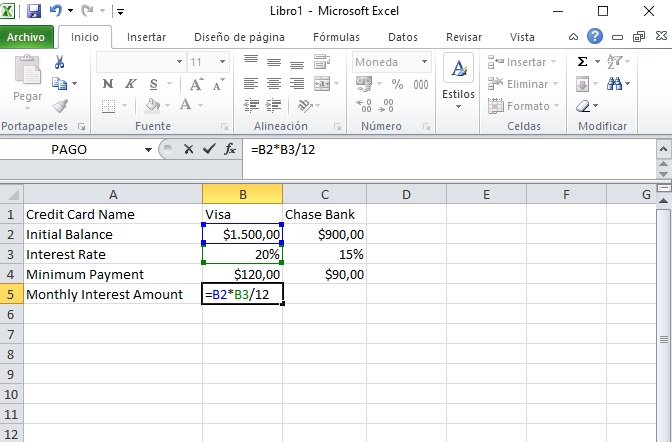

Step 3, calculate the monthly interest amount

We will make a formula in row 5 for each column that has a credit card.

Start by locating cell B5 and type the following: =B2*B3/12. Hit the enter key, and you will have the monthly interest amount.

If you have more than one card, just copy the B5 cell and paste it in the cells next to it; in this case, we pasted it in C5.

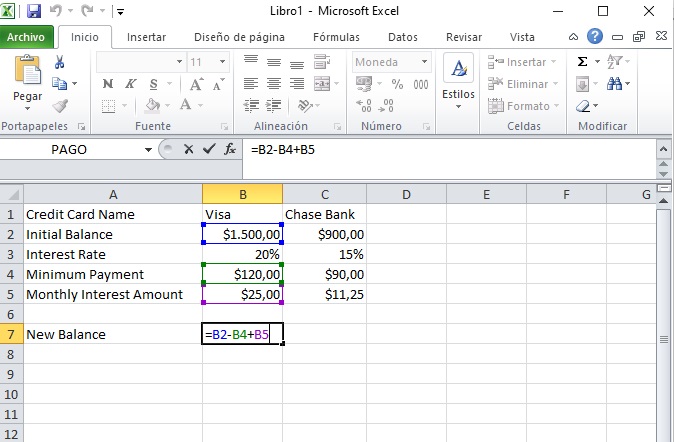

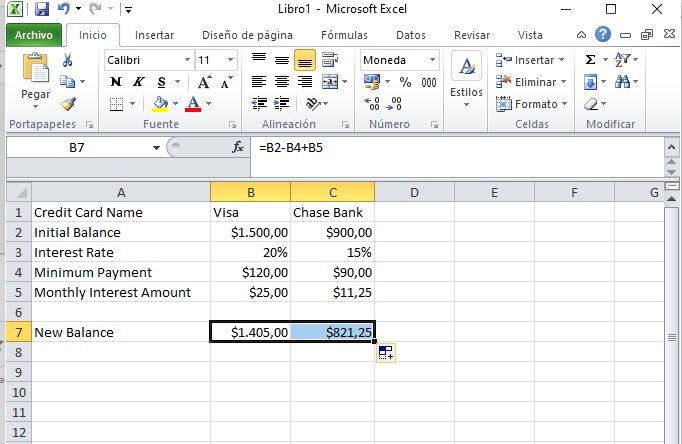

Step 4, calculate your new balance

You should always know what your new balance will be after calculating interests. So, in this example, we will locate this description in cell A7 and write the following formula in B7: =B2-B4+B5.

Then, copy the cell and paste it on each column for each credit card, just like we did before.

Step 5, totalize your interest fees

Finally, calculate the total payment you will have to make for all cards. Write “Total Payments” in cell A9, and create this formula in B9: =SUM(B7:C7).

If you have more than one card, instead of “C7”, you should write the letter of the last column you have.

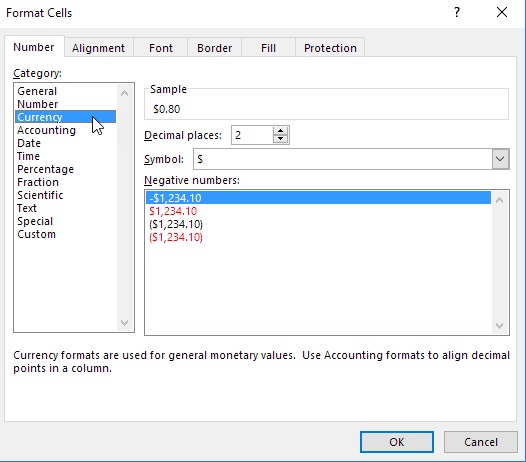

Note: Be sure to put the correct format in each cell, so that Excel can process the formula and give correct calculations.

After writing any number, right-click the cell, and click Format Cells (or press Ctrl + 1). Then, select “currency” when referring to money, and “percentage” when referring to rates.

For your convenience, in this link, you can find more details about formats and how they work.

If you are interested in how to pay your credit card bills, you can do it by setting up autopay or sending a check. The advantage of this is that if you pay the entire bill, you will not be charged any interest! So these are great options of payment, and on top of that, you might want to know where can I cash a personal check.