Many taxpayers would ask this question about what is FICA, and why we are paying our money to it; rather, many individuals are still confused about paying their share of contributions and taxes to date.

FICA stands for Federal Insurance Contributions Act, it includes both the employer and the employee contributions for Medicare and Social Security. However, the employers also need to pay their share of contributions to FICA for each of their employees.

The main aim of FICA is to minimize the difference between your gross pay and the actual amount you take home.

How to calculate your take-home pay?

Contents

It is easy to determine your paycheck before you start doing a job. You can also determine how much you will take home after getting all the deductions such as state tax, federal taxes, and any other taxes as applicable.

Gross pay amount

To calculate this amount, you need to divide it by several periods with the annual amount. If your company is paying you on an hourly basis, you have to multiply that rate by 40 hours. This will get your weekly pay.

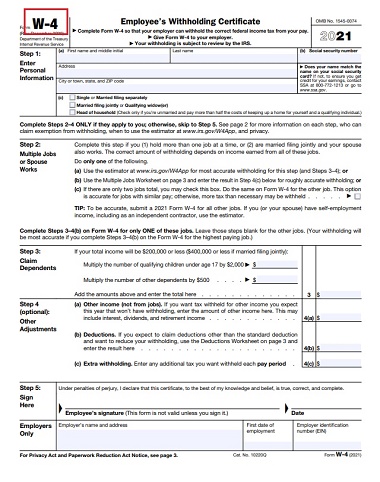

Personal exemptions

While beginning to work on your new job, you need to fill out a W-4 form. This will give your information to your employer on how much you owe from your paycheck.

Tax filing status

You need to check your state and federal tax deductions carefully. Though, this also depends upon your marital status.

Payroll deductions

It includes contributions made towards health insurance, life insurance, 401k plans, and other expenses. These also ensure you calculate the pre-tax and after-tax deductions. This should be either deducted from your after-tax or gross pay.

➡LEARN MORE: What is your Estimated Tax Liability for your First Twelve Months of Business?

How to calculate your taxable income

You need to calculate your FICA taxes for a single year. These are also known as Medicare and Social Security Taxes. You need to pay a flat tax rate of 7.65% just like everyone does on your first $128,000 from your income. However, you can bring down this amount to this percentage while making other calculations.

The second process you need to follow is to calculate your gross income. To calculate this, you need to subtract the standard deductions and the personal exemptions for calculating your income tax. However, there is a constant change in the rate of personal exemptions.

The next subtraction you need to do is your standard deductions. Like personal exemptions, these deductions also keep on changing regularly on yearly basis.

When you have deducted the amount from your standard deductions and personal exemption, you will get an approximate taxable income from your earnings.

How to calculate income taxes

Various taxes are levied upon your gross pay such as state taxes, federal taxes, and other local taxes. Paying the federal taxes depends upon your tax bracket and your filing status.

If you are currently staying in a personal income tax region, you need to determine your state tax bracket. This will get you to take home your salary.