In all the countries of the modern world, taxes have been created as a form of income to the State, and for this purpose, governments should create an institution so they can administer this central activity. In our country, this institution is called the Internal Revenue Service (IRS), in addition to state and local agencies (which also administer taxes). Although they are governmental institutions, this does not mean that we do not have access to them. The IRS offers customer service and the state agencies do so as well.

These revenues are used to finance everything related to public expenses, thus, when we are paying taxes, we are paying so that the government can perform the administration function of our country.

In this article, we will explain how you can contact the IRS and consequently solve any problem you have related to your taxpayer condition.

What is the IRS?

Contents

As we mentioned above, the IRS is a bureau of the Department of Treasury in charge of administering and enforcing the internal revenue laws of our country. It was created under Section 7801 of the Internal Revenue Code and in turn, its operation is supervised by a Commissioner appointed under Section7803. The IRS customer service is one of the many services that this institution offers and can be very useful when filing your taxes.

Surely you have already had to pay the corresponding taxes according to your profession and amount of income and you are already familiar with this service, however, that does not deprive you of having any questions related to your return. Or if, on the contrary, it is the first time that you have to pay taxes, it is normal for you to be confused with the terms or procedures related to your taxes.

Under any situation that you may find yourself in, it is valid if you request help from IRS agents, who are trained to meet the requirements of nationwide taxpayers.

3 Ways to contact the IRS customer service

If you have questions when completing your return, keep in mind that the IRS offers a fairly comprehensive and useful customer support service. They have available phone lines, interactive assistance tools, and even scheduled appointments at their offices.

Depending on your particular situation and the inconvenience you have, you can either solve it over the phone or make an appointment at the nearest office.

IRS Phone numbers

IRS phone lines are available Monday through Friday, and depending on your taxpayer condition, there is a set of numbers and hours.

- Businesses: 800-829-4933 (7 a.m. – 7 p.m. Local time).

- Individuals: 800-829-1040 (7 a.m. – 7p.m. Local time).

- Estate and Gift Taxes: 866-699-4083 (8 a.m. – 3:30 p.m. Eastern Time).

- Excise Taxes: 866-699-40968 (8 a.m. – 6 p.m. Eastern Time).

- Excise Taxes (Forms 706 or 709): 866-699-40838 (8 a.m. – 3:30 p.m. Eastern Time).

- Non-profit Taxes: 877-829-5500 (8 a.m. – 5 p.m. Local time).

- International taxpayers: if you’re one of them, you may visit this page.

Different Languages

For non-English speakers, the IRS customer service also offers a hotline with assistance in interpretation services in more than 300 languages. Dial 800-829-1040 to communicate with agents who speak Spanish or call 833-553-9895 for any other language.

Once you call, an agent will assign you an interpreter over the phone to help you with your request.

Customers with hearing difficulties

For people with this type of impairment, specialized care can be requested by calling 800-829-4059.

Scheduled Appointments

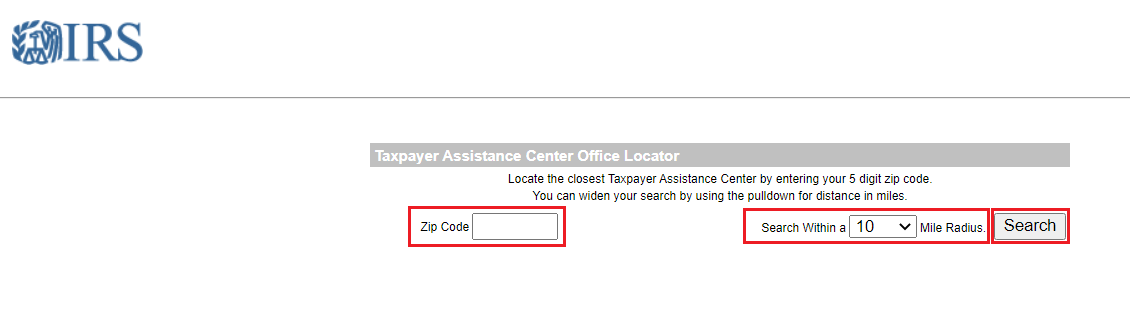

If your request cannot be solved by phone or the procedure you must do is only in person (for example applying or renewing Individual Taxpayer Identification Number), your appointment can be made easily.

Click on this link, write your zip code, and press “search”. Once you do, you will see the information for the nearest local office on the screen. In addition to the address, you will be able to see the telephone number of the agency; you must call them and request an appointment.

READ MORE: Find out if I owe the IRS money

Complex Tax Topics

Although the IRS customer service through phone is very suitable for most of the requirements of taxpayers, certain topics cannot be addressed by phone due to their complexity.

In these cases, the best thing for you is to make an appointment at the nearest local office and thus you will receive more personalized attention. In this way, you will be able to raise your situation with the agents and they will be able to respond to your request in a timely and satisfactory manner.

Before calling the numbers that we put above, we recommend you to review this page and verify that your request is not classified as “complex”, so you do not waste time and do not saturate the telephone lines for other users.

The waiting time to be answered by phone is approximately 15 to 27 minutes, depending on the number of users and the filing season.

Interactive Assistant Tools

The IRS customer service also provides a series of “tests” that will help you clarify some tax questions related to your specific case, without the need to call or make an appointment. It’s worth noting that is a computerized tool that can indicate a quick response to your request, depending on your taxpayer’s condition.

In case your doubt is not clarified, you can always call them or schedule an appointment.

By clicking here, you may verify all the interactive assistant tools. Choose the one that fits you, answers the questions, and clarify your concerns.