When tax season is coming, we know that we should keep our money to pay our IRS debts. Paying our taxes is a responsibility that we have as citizens and we must comply with our tax liability. Owing money to the IRS may become a situation that would affect our pocket since, if we have a delay in payment, we will surely have to pay an additional amount; this additional amount is known as a penalty.

Many times we can make an estimate of our tax return but, is it possible to verify anywhere the exact amount of how much money we owe to the IRS? The answer is yes! It is also possible to find out more information about your payments.

In this article, you’ll find information related to this important and useful topic for all taxpayers.

How does IRS taxes work?

Contents

As you may know, almost every citizen in our country must pay taxes on their annual income and the amount varies depending on how much you earn or produce during a given year.

It also depends on your specific condition, that is, how many dependents or jobs you have, your age, even if you or your close relatives have disabilities can affect your tax amount as well.

The world of taxes is huge; this means every person has to take a look at their finances and living conditions in order to determine their tax amount; there are also deductions and exemptions that may affect your tax return.

Consequently, people who have the same job and the same income can actually pay different amounts on their tax returns.

Checking how much you owe to the IRS, ONLINE

The Internal Revenue Service always tries to expand its services by including new tools for taxpayers to have more facilities to pay, file, and verify their tax returns.

You may have already paid your taxes by filing your return through their online tools, which leads to you having an account on their platform. On that same account that you’ve been using, you can verify how much you owe IRS.

It is possible to also pay your IRS taxes by mailing a money order or a check (do not send cash through this method). You just have to provide your personal information and fulfill some of the requirements listed on their website, but most importantly, you should also know who cashes personal checks.

Don’t get alarmed if you’re new to this, if you don’t have an account yet, we’ll tell you how to do it.

It’s worth noting that this platform is available 24 hours. You can’t access it at midnight or Sundays, only during specific hours. Here are the hours of availability:

- Monday through Saturday: from 6:00 a.m to 9:00 p.m. ET.

- Sunday: from 10:00 a.m to midnight ET.

Regular taxpayers

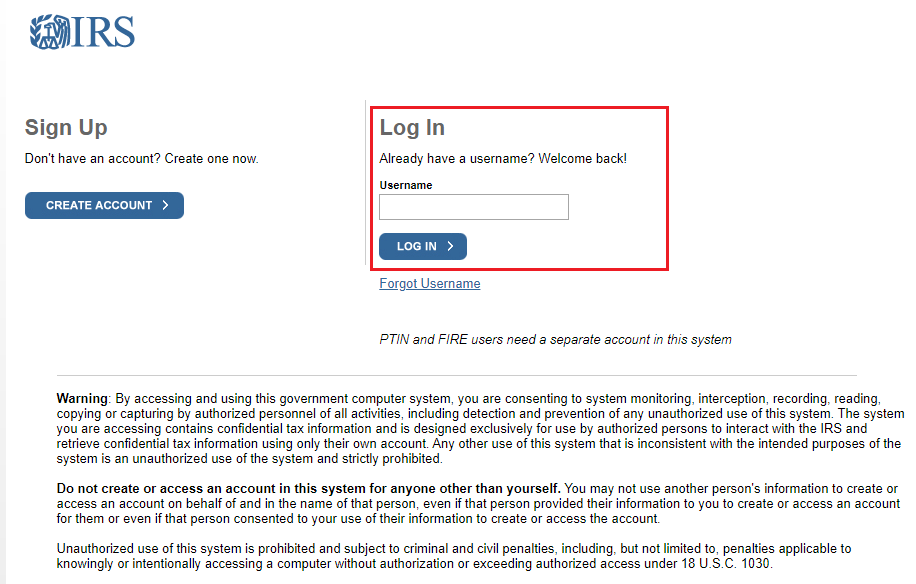

If you have already used the Online Account tool, then to verify how much you owe the IRS you have to log into your account and follow the tool’s prompts.

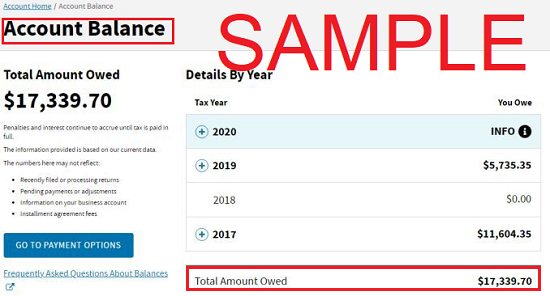

Select “Account Balance” and you will see on-screen the amount of your debt.

This platform generally takes one or three weeks to post your payments, so if you’ve sent a payment recently and when you log into your account it’s still on screen “total amount owed” don’t worry about it. You just have to wait for a little for the platform to post your payment.

Regarding interest and penalties, the thing is different. The tool updates this every 24 hours so that when you’re verifying your debt, it will be an updated amount.

READ MORE: How much interest does the IRS charge

New taxpayers

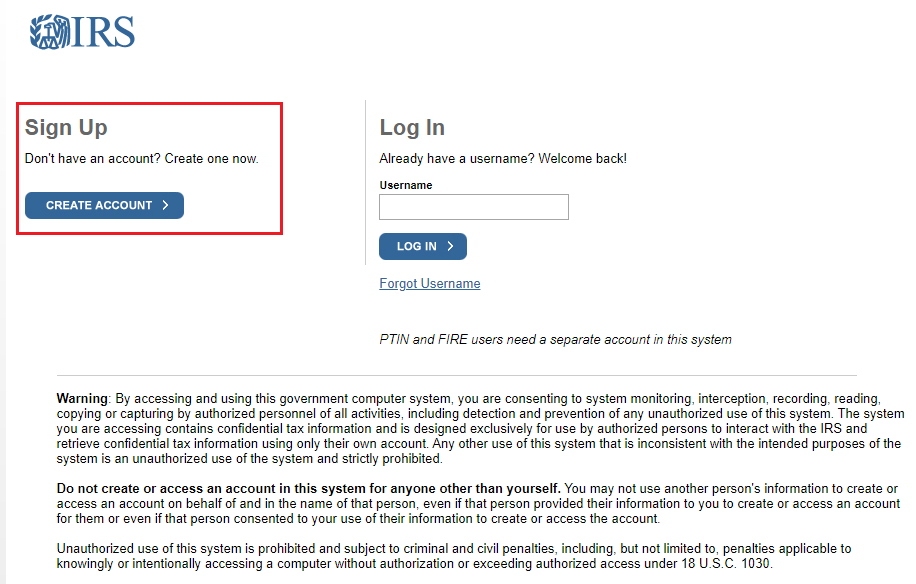

If this is your first time on this platform, you need to register using the secure access process. This is a process used by the IRS to verify your identity so that no one else has access to your account.

You need to go to their official website, click on “create account” and write the information they ask you. Before doing this, we recommend you to have:

- Individual Tax Identification Number (ITIN) or your Social Security Number (SSN).

- Email address.

- A mobile phone linked to your name.

- Tax filing status.

- Mailing address.

- One financial account number linked to your name such as:

- The last 8 digits of a MasterCard, Visa, or Discover credit card (you cannot use American Express).

- Mortgage or home equity loan.

- Auto loan.

- Home equity line of credit (HELOC).

- Student loan (don’t write any symbols, only the numbers provided on your statement).

Once you’ve entered all your basic information, the fastest way to verify your identity is by receiving an activation code on your cell phone. The IRS will send you the code and you’ll have ten minutes to submit it on the platform.

If you don’t have a U.S.-based phone, you can select the option “receive an activation code by postal mail”. Doing the identity verification through mail delays the process since the activation code takes within up to 10 business days to be received. For this case, the code will last 30 days. In the letter, you’ll find the instructions to complete the process.

Once you’ve completed the registration, you only need to select the “account balance” option to verify how much money you owe the IRS.

Other ways to find out how much you owe to the IRS

Calling the IRS

You can also verify the amount of your debt by calling the IRS and requesting information about your account statement.

If you are an individual taxpayer, you may dial 1-800-829-1040 during the hours between 7:00 am up to 7:00 p.m. If you are a business owner or if you represent a company, you need to call 1-800-829-4933 within the same hours.

When you make the call, you may have to wait on the phone until a representative from the IRS picks up your call. The waiting time may vary from 20 to 30 minutes until the IRS responds to your request.

Account Transcript by Mail

If you file any of Form 140- series, you may request an account transcript to verify how much money you owe to the IRS. You may go to this page, enter your ITIN or SSN, date of birth, street address, and ZIP code. Follow the next steps and you will receive your account transcript.

Note that this document will contain information for a single fiscal year and may not contain additional charges (such as interest or penalties). Likewise, you must remember that you will not receive the mail immediately. Consequently, during the days that your request is processed, it is possible that interest will continue to accrue.

We encourage you to use the Online Account platform and get the exact amount you owe to the IRS immediately.