Every beginning of the year, until the month of April, we must comply with our tax liability of filing and paying our federal taxes. But many times, the deadline is getting closer and we still don’t have our taxes ready, this is when we ask ourselves: what can we do? And the answer is to request an extension. Applying for the 1040 extension has become a great relief for individuals when completing their return since they extend the deadline and avoid paying penalties.

The Internal Revenue Service (IRS) is aware that taxpayers are often unable to comply on time and offers this option to make tax liability a more enjoyable process for taxpayers.

Keep reading and you will find how to request the 140 extension.

How do Tax-Extensiones work?

Contents

Many people tend to get confused and think that when requesting a tax extension, the deadline for their return is extended and they can file and pay after the established date. And it is not entirely wrong to think like this, but it is important to know that an extension only gives you the opportunity to filter your tax returns and does not extend the payment date. This means that even if you request the 1040 extension, you must pay by the deadline established by the IRS.

Generally, tax extensions work automatically once they are requested and give the taxpayer 6 more months to fulfill their tax liability. It may be that the time is less, as for example the case of taxpayers who are outside the country, whose extension is 4 months instead of 6.

Every year, until April we have the opportunity to file and pay our taxes. The deadline is almost always April 15th, and people who meet their obligation by date will surely have to pay penalties. But, if you cannot comply on time, you always have the option of requesting the 1040 extension to file your federal income statement.

Once you make the request and it is approved, you automatically have 6 more months at your disposal to file your tax return. So the deadline is no longer April, 15th but you have a chance until October, 15th. Remember that it only operates for the obligation of filing your returns, the date for paying your taxes is not extended.

2021 Relief

As we mentioned before, the deadline is usually April, 15th but in this year 2021, the Department of Treasury and The IRS have declared that the deadline for filing federal taxes runs from April 15th to May 17th, 2021. This means that you have the opportunity to make your statement until May 17, without requesting any extension.

How to request the 1040 extension

First and foremost, you should know that the extension is requested through a form.

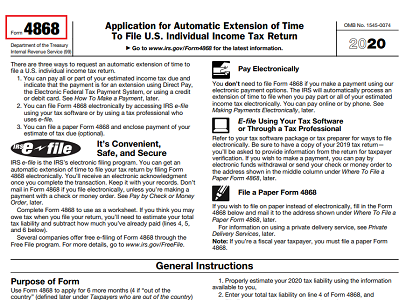

This form is 4868 and at the time of completing it, you must estimate your income tax due (that is, how much you have to pay) and pay all or part of the amount owed.

It is an extremely simple form to fill out. In lines 1 to 3, write your identification data (name, address, social security number, zip code).

Next, in Part II, on lines 4 and 5 write your estimated income tax due and all the payments you made during 2020, respectively.

In box 6, write the result of subtracting the amount on line 5 from the amount you wrote on line 4, and in box 7 write the amount you are going to pay at the time of requesting the extension. Mark lines 8 and 9 only if you meet what is stated there.

To complete it you have 2 options, by Mail (on paper) or through the internet.

Online

The IRS offers taxpayers the Free File service. Regardless of your income amount, you can request your 140 extension via the internet.

This service is part of the IRS Free File Program; in which various software are authorized by the IRS so that taxpayers can make their tax returns from their homes. Enter this page, select the software of your choice and request the extension.

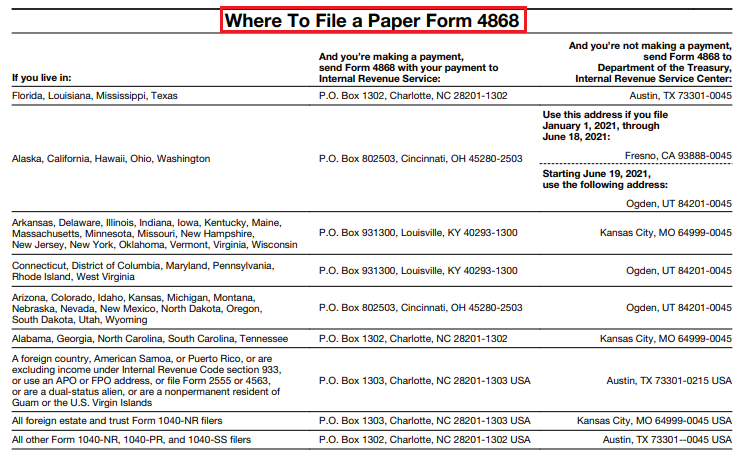

Complete the forms, put them in an envelope next to your Form 140, but don’t staple them. The form of payment can be a check or money order payable to “United States Treasury”. You may not send cash.

The addresses vary depending on the state where you reside.

READ MORE: How can I get a discount on TurboTax?

When should I request the tax extension?

As it is an extension to comply with your tax liability, you must request it before the expiration of the period so you can pay without penalties; this is before April, 15th or even on that exact day. However, certain circumstances apply for people who are outside the country by the time their delivery deadline expires. In the instructions of Form 4868, you can verify this information.

2021 Considerations

Since there is tax relief and the date to file the federal tax return has been extended until May 17th, you have the opportunity to request the 1040 extension until that day.

How do I know if my extension was approved?

Once you request the extension, if you do not receive a notification that there was an error, you have automatically been granted the 1040 extension.

In case you have made a mistake when completing it or there is any inconvenience, you will receive a notification indicating that the extension was not approved and thus you will know that you have to comply with the established deadline.