While you are filing for a tax return, you might want to ensure it is as precise and complete as possible to prevent Internal Revenue Service’s penalties and audits. If the data you report on your tax return fails to match your bank records, you should be concerned; unintentionally or intentionally, you might raise a red flag or trigger an audit that may bring consequences for your check deposits.

This is a complete guide where we tell you when and why do banks report check deposits to the IRS and inform you of all the possible transactions that can land you in a risky situation.

Situations where the IRS might monitor your check deposits

Contents

It is relatively easy to assume that the Internal Revenue Service (IRS) is tracking every financial move we are making. However, it is certainly not true for the majority of people. Whether banks report financial transactions and check deposits to the IRS really depends on the deposit amount.

Indeed, the IRS does not have so much time to keep track of every single transaction or check from every other individual in the United States.

Hence, the Internal Revenue Service does not really keep a check on financial transactions or check deposits unless you give it a specific, unusual, or alarming reason to do so.

The IRS basically trusts the smaller transactions to be included within your tax return every year, i.e., if you make it above $10,000. However, $10,000 is the ultimate value that causes the IRS to be on high alert. Hence, the IRS might start keeping a close watch on your bank transactions.

$10,000 is the income when individuals can start filing their tax returns. Still, it is also a significant value to start being questioned by the IRS regarding your transactions’ legitimacy. Here are some situations that might cause the IRS to be vigilant and are worthy of being monitored.

Cash or Check Deposits of $10,000 or above

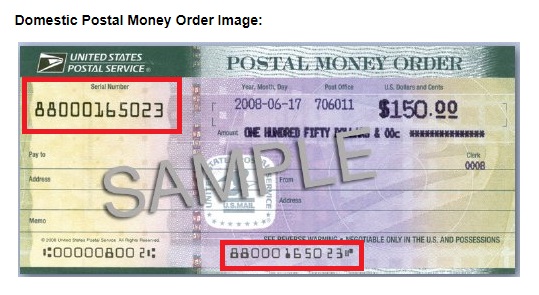

It clearly does not matter whether you deposit cash or cash your check. Whenever you make a $10,000 or greater deposit in one transaction, your bank is required to provide a report of this transaction to the IRS.

Your bank should also report the financial transactions if you make 2 deposits of $10,000 or greater within a day of the initial transactions.

Numerous Payments of $10,000 or above

The threshold of $10,000 does not exclusively apply to cash and check deposits made by you in person. Even if another concerned party makes a deposit in your bank account or transfers more than one payment worth $10,000 or greater within a period of one year, your bank must report these transactions to the IRS.

Suspicious and Unusual Activities

Even when your deposits or transactions do not cross the $10,000 threshold, your bank can still report them because they deem them worthy of reporting. The IRS might request financial institutions to keep track of any sort of suspicious activity.

This could imply a sequence of similar deposits over a certain period or large transactions. If your bank identifies you for such activities, you might be considered suspicious in the eyes of the IRS.

IRS Audits

If, for instance, the IRS audits your returns, the bank needs to provide any such reports of your account. Your bank needs to report all sizes of transactions conducted from your end to the IRS in such circumstances.

Other Circumstances

Though random requests are usually quite rare, it is technically possible for the IRS to request banks for data on your transactions whenever they require.

What Happens When I Make Transactions over $10,000?

When you make any such transactions with amounts exceeding $10,000, you will need to fill out Form 8300. Your bank will send this form over to the IRS. Form 8300 requires you to provide information on specific areas like:

- The personal information of the individual who is sending the money, including their name, birthdate, address, occupation, and taxpayer ID number.

- The personal information of the individual who is depositing funds into their account, including name, birthdate, address, occupation, employee ID number, taxpayer ID number, and alien ID.

- The details regarding the transaction, including deposit amount, date of transaction, if there was more than one transaction, the overall nature of the transaction, and the amount collected from every payment method.

- The details of the type of business that received the amount, including the business’s name and address, and the Social Security number and employer ID number.

Form 8300 is actually a measure for aligning everything together to prevent any sort of criminal or money laundering activities in the American banking system. The only significant exception here is for financial transactions that take place between immediate family members.

Suppose anyone from the family writes an extensive check for a child. In that case, even if it is over $10,000, it will probably go unnoticed.

Do I Need to Worry About My Check Deposits Being Informed to the IRS?

Even if your bank reports your cash or check deposits or withdrawals exceeding $10,000, it is not necessarily an alarming cause. As long as the transactions or deposits are not construed as illegal and it is identified where the money is going, there is no need to worry.

Instead, this helps the concerned authorities to find out if your account has been bargained and if the incurred transactions are suspicious or fraudulent.