Generally, most workers can receive a salary increase percentage for their well-executed work. Since ancient times, working is the most common way of earning money, which results in the human behavior of trading goods and services.

In consequence, in this article, you will find a short guide to use Excel as a method for estimating your salary increase.

What does salary increase percentage mean?

Contents

Before starting with the calculation of your increase, it is important to remember that a salary is different from an hourly wage.

- Salary is the amount of money that a worker receives on a fixed basis as compensation for his services; the amount is calculated according to the conditions established with the employer.

- An hourly wage is a monetary compensation that a worker receives based on the number of hours he will have to work.

In addition, sometimes your employer can increase your salary by a certain percentage. This can occur due to many reasons, among the most common we find: good performance, extra work, or increased production thanks to your efficiency in your workplace.

This salary increase is generally delivered in the same way as your regular salary. That is, if you are paid monthly with a transfer to your bank account, you will receive the increase in the same way. If they pay you with checks, the extra money will most likely be in your monthly paycheck or they can issue a new one especially for the increase, as a reward.

In any case, remember that in order to have the money that they give you in a check, it is important that you know in advance where you can cash a personal check.

➡ READ ALSO: Calculate credit card interest in Excel

How to use Excel for this purpose?

Microsoft Excel is a very useful tool in terms of mathematical operations. Thanks to all the functions that the program has, it is possible to perform any calculation in minutes by using the pre-determined formulas or creating one of your own.

In this case, we will use it to show you what is the increase percentage after receiving a higher salary.

Step 1

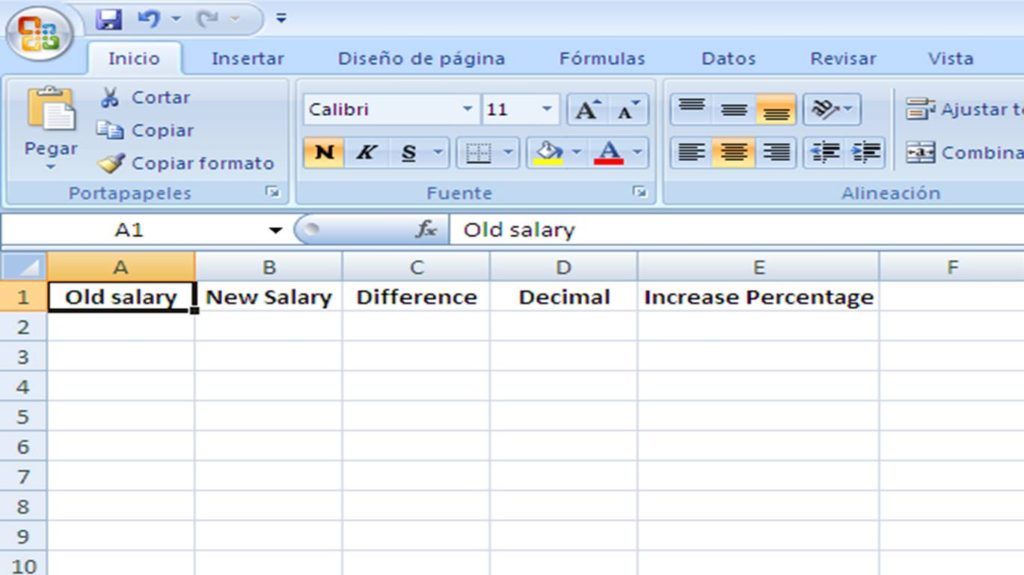

The first step is to create a new document in Excel and identify the cells before writing the data for the formulas.

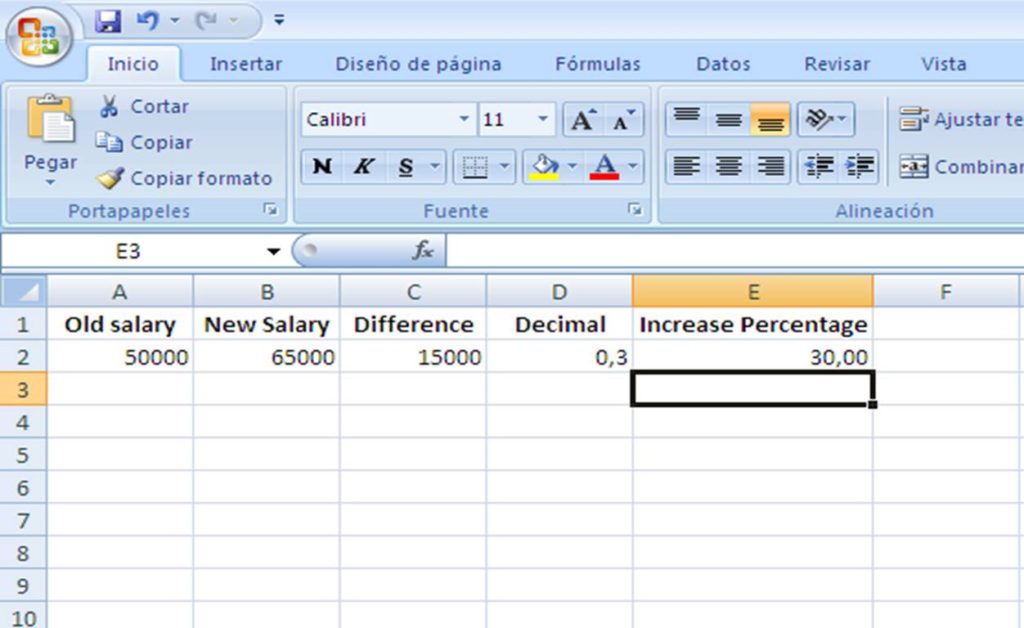

From cell A1 through E1 write the following: old salary, new salary, difference, decimal, and increase percentage.

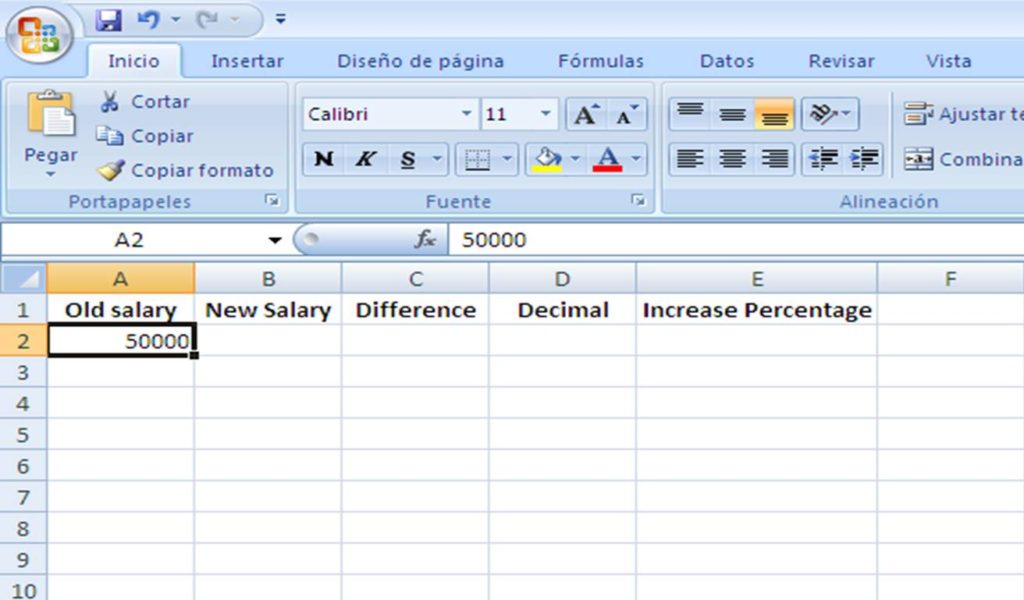

Step 2

Then, in cell A2 write your salary before getting the increase or bonus. For instance, if your last payment was $50,000, then write 50000.

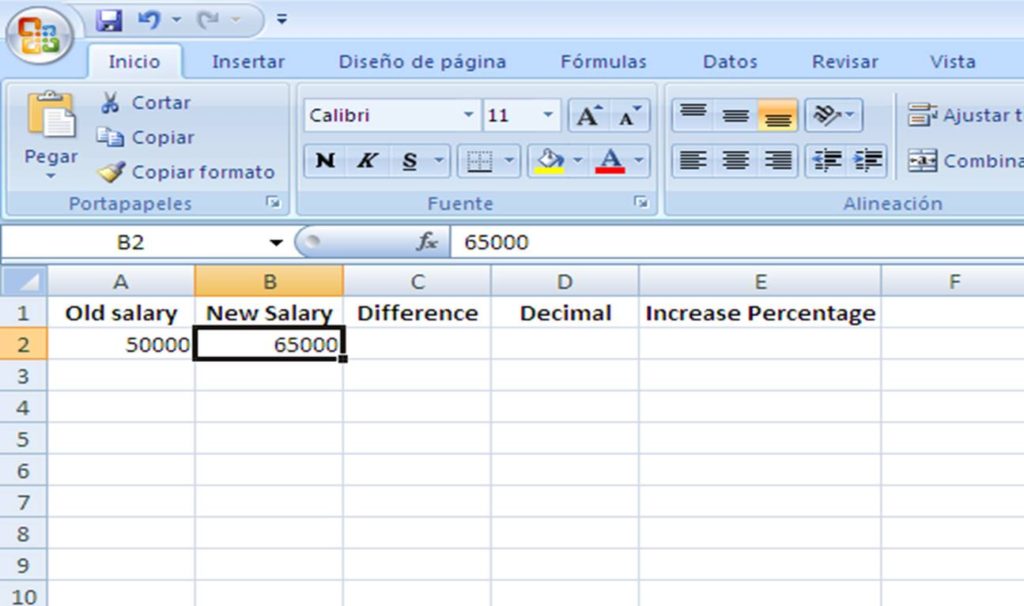

Step 3

In cell B2, you will write your new salary. For example: if you accept a new position that pays $65,000, write 65000.

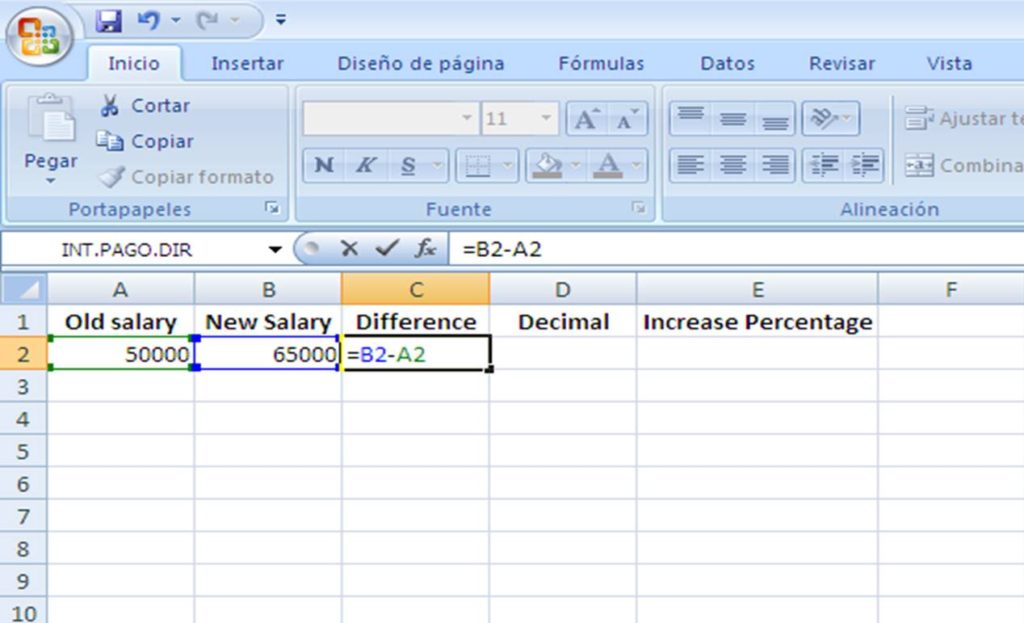

Step 4

Then, the first calculation you need to do is subtracting your old salary from your new one. In cell C2 write: =B2-A2 and press enter. Automatically, cell C2 will show the difference between both.

Step 5

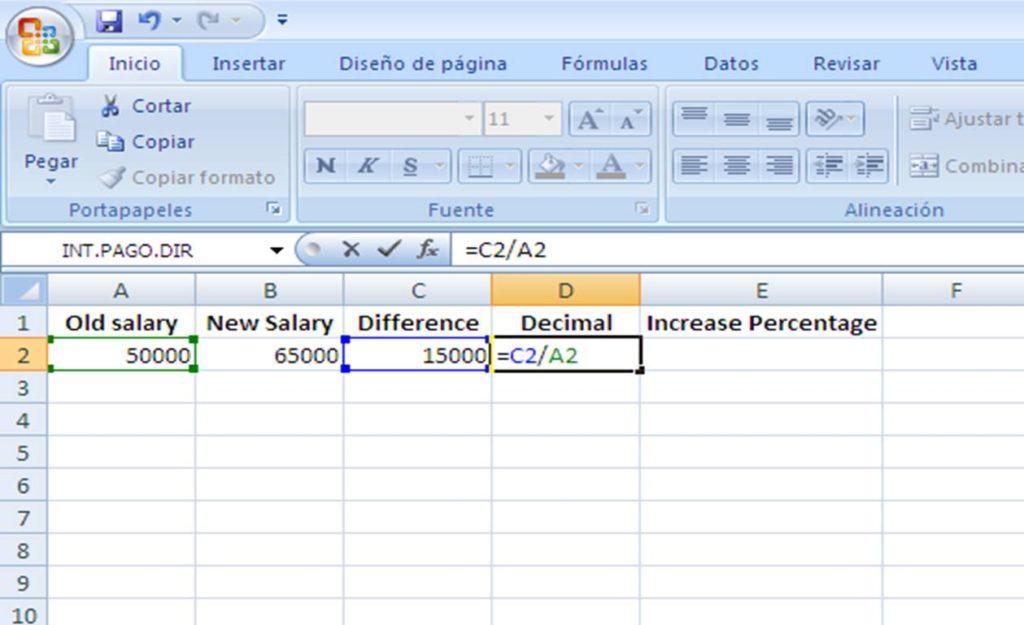

In cell D2, you will transform the difference into a decimal, so that you can use it later in the percentage formula. To do so, divide the difference by the amount of your old salary. Write: =C2/A2 and press enter.

Step 6

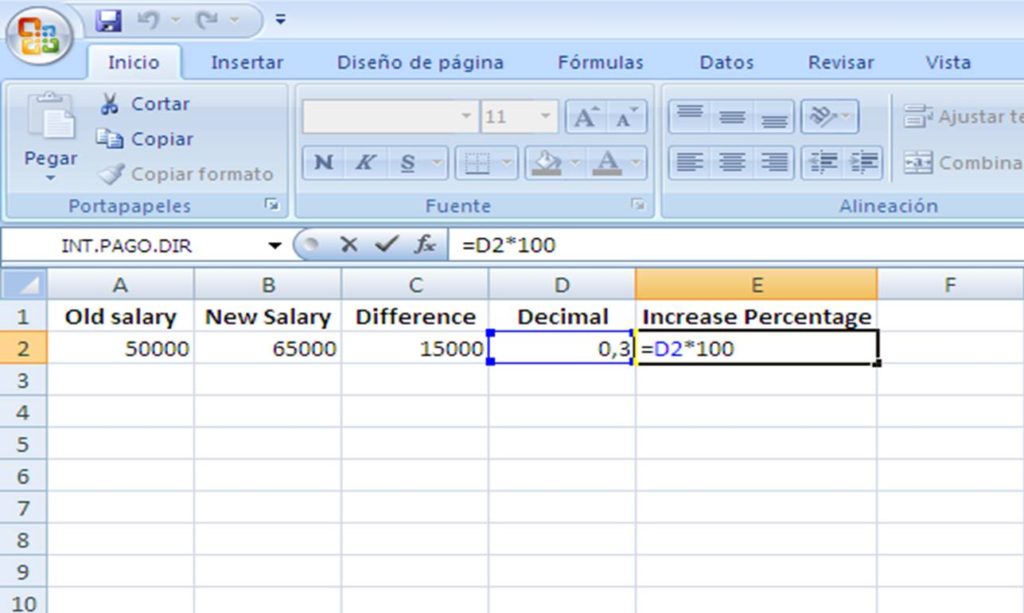

Now, you only need to turn the decimal into a percentage by multiplying it by 100. In cell E2 write: =D2*100 and press enter. Based on the example, if you got a $15,000 increase, this means that you received a 30% increase.

Gross salary vs. Overtime

In the same way that you can calculate the percentage increase in your salary, Microsoft Excel can also calculate the amount you can receive for overtime and the amount of your gross salary.

For your convenience, in this video, you can learn how to calculate your overtime payment.

On this page, to calculate your annual gross salary.

The gross salary is what that the employer pays you without including deductions that are generally made, such as taxes or insurance.

In contrast, according to the U.S. Department of Labor, overtime is the number of hours an employee works outside of the legal 40 hours in a normal workweek. In that case, if you worked 45 hours, you should be paid 5 overtime hours.

The Fair Labor Standards Act (FLSA) states that all employers must pay their workers the amount of at least 1 regular pay rate for each overtime hour.