The EIN or Employer Identification Number is a 9-digit number that identifies your company and is assigned by the Internal Revenue Service (IRS) of the US. You need it to pay federal taxes, hire employees, open accounts, and apply for licenses or permits.

The application process is free and you should only do it if the company is already registered.

If you are one of the owners or founders, and you are interested in knowing how to get an EIN, you have found the right article.

Differences between tax IDs

Contents

It is common to find people confused with tax terminology; so, the first thing you have to do is to identify and understand each one correctly.

EIN – Employer Identification Number

It is basically the company’s registration number for the IRS. This allows operations and management to be much easier, since you can:

- Open a commercial bank account.

- Register payment methods.

- Get better customers and suppliers.

- Hire employees.

- Request permits or licenses.

- Among others.

In this case, at least one of the owners must have a Social Security Number (SSN).

ITIN – Individual Taxpayer Identification Number

This is an identification made only for individuals, not companies.

It doesn’t give you any benefits or permission to work, but it does allow you to open a bank account and make tax returns.

SSN – Social Security Number

This number is what identifies you within Social Security, and allows you to keep track of your salary or earned income. To receive or apply for this number, you must be a US citizen, permanent resident, or temporary foreign resident (working in the country).

Tax ID

Unlike all the previous ones, the tax ID or TIN (Tax Identification Number) is a generic acronym that is used to identify a company or natural person.

For example, if you are filling out a form, and in one of the questions they request your “Tax ID,” you must put the number depending on who is filling it. If it is a company, you must write the EIN; if it is an individual, you must write the ITIN.

It is also important to note that the SSN is issued directly by the Social Security Administration, and the Internal Revenue Service issues all others.

➡ READ ALSO: When Will the IRS Accept 2021 Tax Returns

How to get an EIN easily

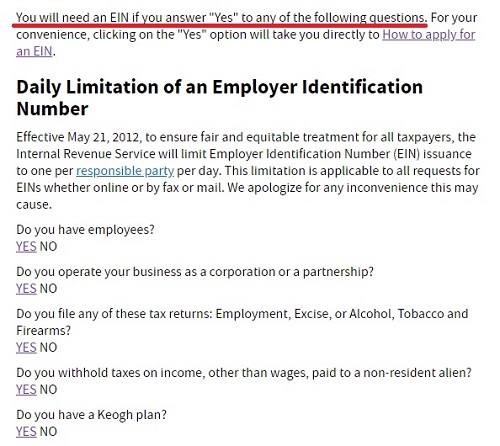

Before applying, you must first know if you need an EIN or not. For your convenience, the IRS designed a questionnaire that can help you; click on the following link and answer the questions. If you answer “Yes” to any of them, you need the EIN: www.irs.gov/businesses/small-businesses-self-employed/do-you-need-an-ein.

After doing this, the fastest way to get an EIN is online, only if one of the owners has an SSN. The other way is to file Form SS-4 and send it by fax or mail.

It is important to remember that this procedure is entirely free.

Keep reading to see all the steps.

Online application

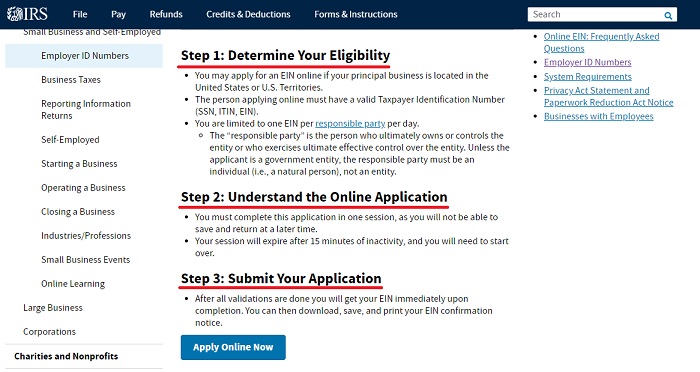

You can apply online, but you have to live in the United States or any of the US possessions.

- Click on this link: www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online.

- Read carefully the three steps before applying.

- Click on the “Apply Online Now” blue button.

- Read the instructions, and when you have understood everything, go to the bottom of the page and click on “Begin Application.”

- Answer all the required questions about the company.

- After you complete it, you will receive your EIN immediately. It is recommended that you download it, print it, and save it with the other essential documents of your company.

Form SS-4

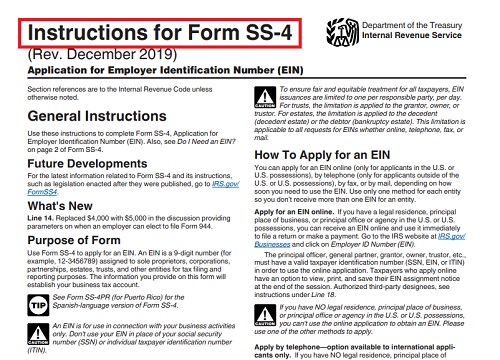

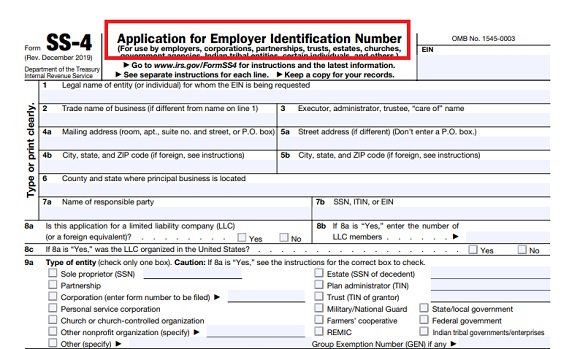

You can also get an EIN by filing Form SS-4, and then sending it by mail or fax.

- First, check the instructions to fill the form at this link: www.irs.gov/pub/irs-pdf/iss4.pdf.

- Download the Form FSS4 here: www.irs.gov/pub/irs-pdf/fss4.pdf.

- Start filling in the required information, such as company name, address, zip code, name of one of the owners, and his SSN, type of entity, among other data.

- Then, print the form and send it by fax or mail.

- You will receive it by mail in approximately four weeks, and by fax in four business days.

Frequent questions

Can I apply for an EIN without an SSN?

Yes. In these cases, the process must be done by an outsourced representative who requests the number on your behalf. Generally, it can be a business lawyer.

Is a US mail address necessary?

No. You can also use an address outside the US, as long as you meet all the other requirements.

Remember that if you have more questions about obtaining an EIN, you can always call the Business & Specialty Tax Line department: 800-829-4933.