In the United States of America, the Internal Revenue Service (IRS) requires all businesses, including child care centers, to have an Employer Identification Number (EIN), also known as Taxpayer Identification Number (TIN) to file their tax returns and to be able to operate optimally.

So, if someone else is taking care of your children and you eventually need their EIN, in this article we will teach you how to find it.

How to find a child care EIN number?

Contents

Usually, people do not need to know the EIN of each organization or person that provides a service. Still, there are some circumstances where you may require it.

For example: if your kids go to a child care center, and you are thinking of applying for tax deductions or credits, you will need that information to fill your application.

So, here are five ways to find this number:

Childcare center’s invoice

Generally, these centers know that parents may need their EIN for tax benefits, like child care credits (the IRS calculates it depending on the amount of your monthly payment), so they put the number on the invoice. This is definitely the first place to look.

Also, on certain types of checks, this number may be required. So if at any time you paid them with a check, or they reimbursed you with a check, you can look there.

On the other hand, if in your search you find a check without cashing and you are wondering where can I cash a check, read this article that we have created to guide you in the easiest way.

Asking information

The second thing you can do to find it is to ask directly in the childcare center. Yes! You may nicely ask the person in charge if they can provide you their EIN, so you can apply to get tax benefits.

It should not be a problem, and they would surely give you the information.

Form W-10

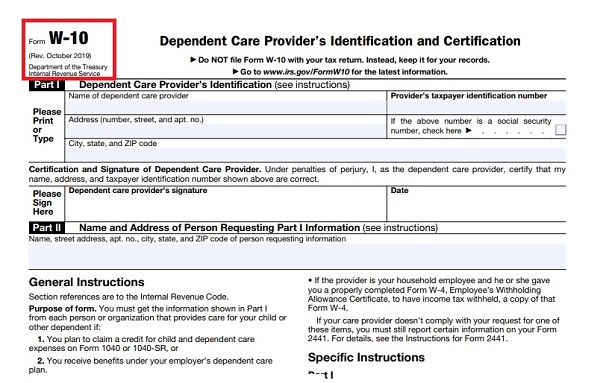

If you have already tried the two ways we mentioned before, and you have not succeeded, you should make a formal petition to the child care center.

There is a form designed by the IRS to obtain their full name, address, and Taxpayer Identification Number (note that it is the same number for EIN).

This is Form W-10, also called “Dependent Care Provider’s Identification and Certification,” as it is shown at the top of it.

You may download Form W-10 by clicking in this link: www.irs.gov/pub/irs-pdf/fw10.pdf.

Once you have done it, you can present the form to your child care provider as an official request, and obtain the information you need.

After you receive the filled form, you may proceed to complete the application for child care expenses, but you do not have to present it with your tax return.

However, you can use Form W-10 for other purposes, like authorizing another person to take care of your children.

State records

Another thing you can do to obtain the EIN is by looking at the official state records of your jurisdiction.

In every state of the country, there is a public database that contains items like formation date, address, and sometimes the EINs of businesses legally authorized to operate. It is an easy way to search.

You may also check online for specific information on the official website of your local Secretary of State. For example, here is the link for California: www.businesssearch.sos.ca.gov.

Third parties

Your last option to obtain the EIN is hiring an agency or a person that locates this type of information about companies, in this case, your child care center. There are plenty of people that do this type of work; if you have not been able to find it by yourself, this is a good option.

➡ LEARN ALSO: Family members be on a non-profit board

In case you are looking to apply for childcare expenses credits, and you do not know what else to do, what documents you need, or even if you qualify, check this PDF provided by the IRS which contains valuable information about that subject: www.irs.gov/pub/irs-pdf/p503.pdf.