When it comes the time to buy a home it is recommended to know the legal terms and concepts to avoid problems during the process. However, the best option is to have a real estate agent to support you.

For example, things like assessed value and fair market price are usually used as synonymous, which they are not. One is necessary to calculate taxes, and the other for the actual value of the property.

If you are thinking about buying or selling your house, in this article you will find an easy guide to understand these terms.

What is the meaning of assessed value?

Contents

The assessed value is perhaps one of the most used terms in real estate matters, and it refers to the monetary value assigned to a property for tax purposes.

In the United States, all states and counties require their citizens to pay a tax based on the real estate they own. The money paid by taxpayers is used to finance urban development projects, such as school construction, local park improvements, bus systems, and street improvements, among others.

As a result, in those cities where the property value is higher, the assessed values will end up collecting more money in taxes. The higher the tax, the better the services.

But this is not a rule; it will also depend on how responsible the states and counties are on spending their taxable incomes.

➡ READ ALSO: Retire on $200,000 inheritance

How to calculate the assessed value?

As we mentioned before, this value is only used to estimate property taxes. The person responsible for calculating this amount is a government assessor (usually a real estate agent), which is assigned by the Municipal Government; this person is in charge of determining the amount of the county real estate appraisal.

Although the standards are practically the same, by the time of making the estimate, the assessor will check the following things:

- Location of the property.

- Value of other houses of similar construction and sizes.

- Size of the parking lot.

- Accessories in the facilities.

- Maintenance and condition of the property.

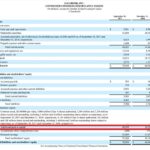

Many of these calculations are computerized, but you can also determine the assessed value of your home by using these two formulas:

1st formula

Market Value x (Assessment Rate / 100) = Assessed Value

You can get the market value by consulting a real estate agent or local officials. And the assessment rate is available on your county’s official website (if you cannot find it, make a call to the department of taxation).

For example:

- If the market value is $200,000.

- And the assessment rate is 80%.

- The result will be: $200,00 x (80/100) = $160,000.

2nd formula

Property Tax Bill x (100 / Tax Rate) = Assessed Value

You will receive the property tax bill one month before the due date; use this information. And the tax rate of your area is usually available on your county’s website (if you cannot find it, make a call to the department of taxation).

For example:

- Let’s say that you received your property tax bill and it says $1,200.

- And the tax rate is 1%.

- The result will be: $1,200 x (100 / 1) = $120,000.

Exemptions

In case you are an owner-occupant, the assessed value may decrease since this circumstance is known as “homestead exemption”. It does not mean that the market value of your house will be affected, it will only decrease your property tax bill.

However, if you consider that the estimate is not correct, you can request a reevaluation on the value of your house.

Generally, the estimation is done once a year and each state or county has its own regulations. In this link, you can find an example of how it is done in Miami.

Fair Market Value vs Assessed Value

A fair market value is the monetary estimate of a property considering its specifications; such as: location, size, size of the parking lot, state of the facilities, among others. It is the amount that the seller proposes to a potential buyer.

Previously, we stated that the assessed value also involves all these conditions of the property, but only for tax purposes.

An important thing to consider is that the assessed value is generally a percentage of the fair market value. This percentage varies in each state; it can go from 10% to 100% of the fair market value. For example: Massachusetts has a rate of 100%, while Mississippi has one of the lowest rates in the country with 10%.