The Internal Revenue Service (IRS) is the governmental entity in charge of managing taxes in our country, for that reason they are the institute with the faculty of indicating which are the due dates for tax payments that correspond to us citizens.

It is important to remember that although the IRS tells us the date on which our obligation to pay arises, there are also opportunities to request an extension and save time. In order to do this, you must request a business taxes extension or personal taxes extension, as the case may be.

The process to request it is relatively easy and you will only have to fill out a form depending on the type of business you run. In this article, we’ll explain to you how to do it in a very simple way.

What is a Taxes Extension?

Contents

A business taxes extension, as its name suggests, is an exception to the due date indicated by the IRS for those businesses that could not file a tax return on time. Thus, the government gives them the opportunity to request an extension (in mandatory principle) so that they can satisfactorily comply with their tax obligations without having to respond to penalties.

It is important to clarify that the extension only applies to the submission of the tax return forms and not to extend the time of payment. It is mandatory to calculate and pay taxes before the expiration date according to the type of business.

Although the IRS allows us to request this extra time, it does not mean that just by making the request they will automatically approve the extension. We must be attentive to the type of business we run, fill out the forms correctly, submit the application form on the appropriate dates, and pay the taxes we owe.

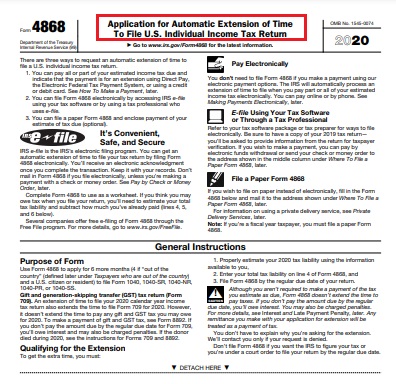

The request is made throughout formularies meant to the purpose; the most used is Form 7004 since it is indicated for most types of business. However, it is not compatible with all businesses.

Form 7004

It is the form used by most partnerships and corporations to request a business tax extension. It also includes LLC businesses filing as partnerships and S corporations.

In this PDF you will be able to obtain Form 7004 and review for which other forms it is valid.

Once the extension has been approved, the IRS gives you a 6-month extension to file your corporate income tax returns and other related returns.

Previously, the IRS notified when a business taxes extension had been approved, but currently, they will only send a notification if the extension has been rejected; so, if you make the request and you do not receive a negative response from the IRS, the 6-month extension has been automatically approved.

There are some exceptions that involve 1041 taxpayers and for C corporations with tax years ending June 30 of each tax year; you can visit the official IRS website to find more detailed information.

How to file Form 7004

Form 7004 can be completed online and in-person with the Internal Revenue Service Center at the applicable address for your return.

Only taxpayers of forms 8831, 8725, 8613, 8612, 706-GS (D), or 8876 should fill it out in person at any IRS office. All other taxpayers listed on Form 7004 can do it online through the Modernized e-File (MeF) platform. On this website, you will find information related to the presentation of this form via the internet.

When to file Form 7004

If you want your extension to be approved, you must submit the application before the due date of the tax return. The corresponding expiration dates can be found in the form whose extension you want to request. By clicking here you may verify the due dates related to 2020 tax obligations.

More Information about business taxes extension

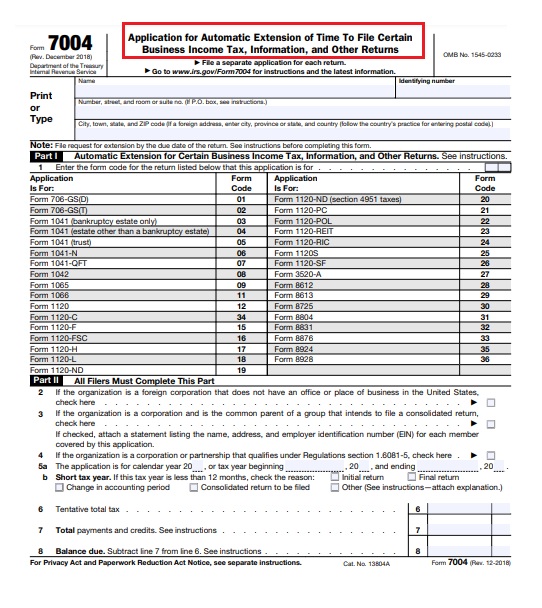

In the case of entrepreneurs who pay taxes as part of their personal tax returns, they can also request an extension to present the documents. But we remind you again that this extension is only for the presentation of the documents related to the return and not to extend the payment deadline.

Click here and you will find the instructions related to Form 4868 used for this type of request, known as “pass-through businesses”.